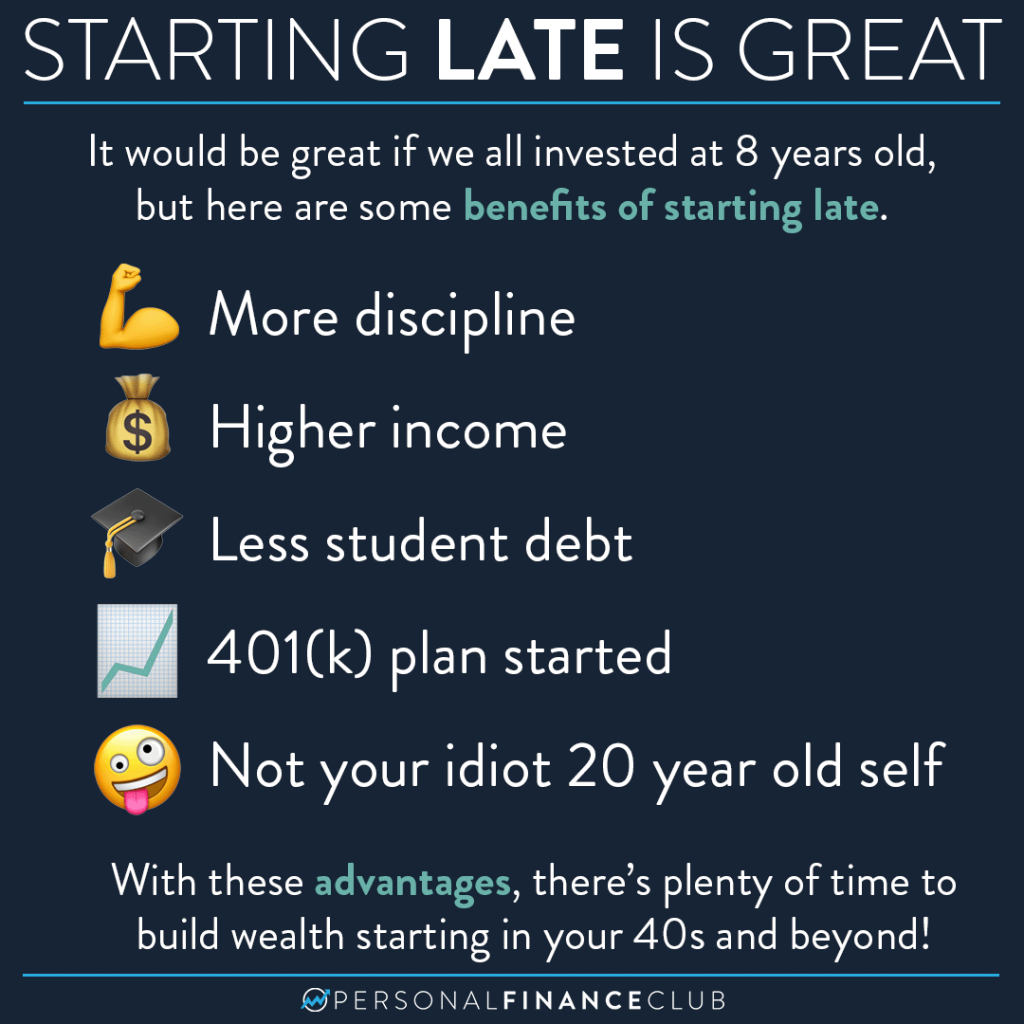

I think nearly EVERY person I’ve ever talked to about investing thinks they started too late. EVERY. ONE. So if you think you’re starting late, you’re in good company. To quote Drew Carey, “There’s a support group for that. It’s called everybody and they meet at the bar.”

It’s tough to start investing when you’re 20. YOU HAVE A LOT OF SHIT GOING ON IN YOUR LIFE WHEN YOU’RE 20. You might be in college, buried in debt, trying to move, trying to date, looking for a job. You shouldn’t feel shame that in the middle of that you weren’t carving out $500/month to plow into a Roth IRA. That’s life.

So now you’re whatever age you are, you’ve found this page and you want to start investing. I’ve got some good news for you. You’re likely in WAY BETTER SHAPE to start investing than when you were 20. You likely have way more discipline and focus on what you’re trying to achieve. You likely have a higher paying job. You likely have less debt. Those three alone are a killer combo to start building a ton of wealth.

Also, a lot of people who are wondering if it’s too late to get started (it’s not) actually AREN’T at the start line. Maybe you have a 401k through work that already has $20K in it. That could represent 4-5 years of investing already! It’s a great start to compound growth.

Also, let’s say you’re 40. Your life expectancy is around 80. That means you still have FORTY YEARS of life left to live and build wealth. That’s a long time for compound growth to work.

So don’t worry about being too late. Be grateful for the launching pad you’re currently on and get started!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

Are you late to investing?

September Sale!

September Sale!