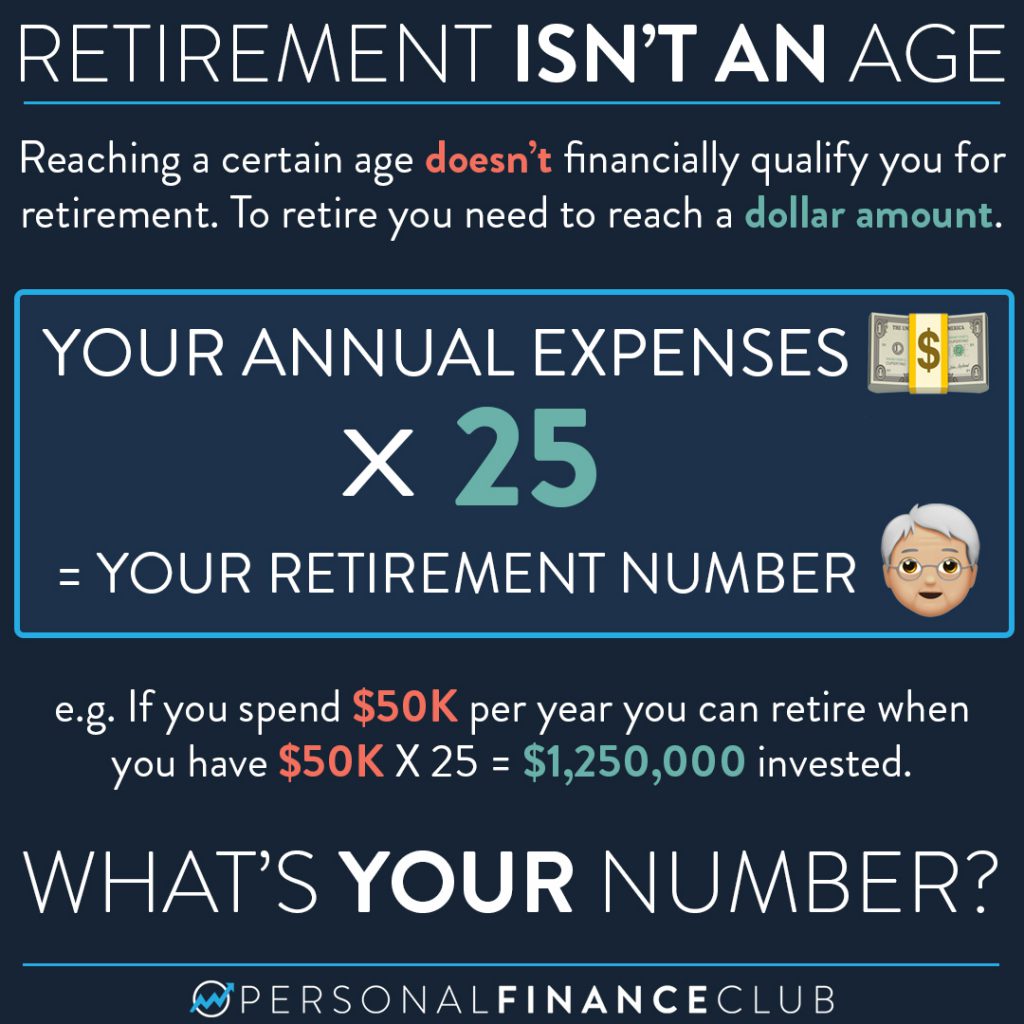

A lot of people go through life with an assumption that when they’re 65 they’ll automatically get to retire. But here’s the thing: Being 65 doesn’t mean you get to retire. If you don’t have any money, you have to keep working (or live in poverty). On the flip side, if you’re 40 and you’ve saved up 25 times your annual expenses, then you never need to work again.

This “25X” rule is based on the Trinity Study. The Trinity Study looked at historical growth and volatility of the market, and basically says if you have a bunch of money invested, you can take out 4% of the starting amount per year to spend, adjust that for inflation every year and never go broke. So if you have $1,000,000 invested at 40, then you can take out $40,000 per year forever and weather all the ups and downs of the market.

So instead of planning to work until a magical age, think about making a plan to lower expenses, invest aggressively and retire young!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

September Sale!

September Sale!