A Roth IRA is a great way to get started investing. Any money you put in is never taxed as it grows and not taxed when you withdraw it!

That can be a big deal. For example, let’s say you contribute $6,500 to a Roth IRA this year and invest it in an index fund. Let’s also say that index fund returns 10%/year and you leave it to grow for 40 years. When you go to withdraw it, that $6,500 from today will have grown to $294,185!

Normally when you make money on an investment the government wants a piece of the action! In the above example, they would say “Ok, you started with $6.5K and it grew to $294K so you owe taxes on the difference, the $288K of growth”. The tax bill on $288K can be a lot (like over $50K).

BUT if you invested inside a Roth IRA, you can withdraw it ALL (after 59.5 years old) and immediately spend it with NO TAXES WHATSOEVER. That’s a big deal.

This benefit is USE IT OR LOSE IT. If you didn’t contribute to a Roth IRA in 2021 it’s TOO LATE to go back and make use of that contribution limit. But don’t worry, it’s not too late for 2022 or 2023! You have until tax day 2023 to make your 2022 Roth IRA contributions! You can start with any amount. Fidelity offers great $0 minimum investments for your Roth IRA.

What if you make, or might make, more than the max income allowed? Well, then you can do a BACKDOOR Roth IRA.

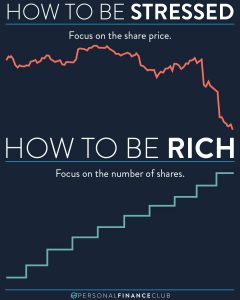

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

via Instagram

September Sale!

September Sale!