Fees are insidious because the quietly drain your wealth without you noticing. When I personally look at my own investments, I think, “hey, that’s pretty good!”, because all I can see is the green part. The red part is what could have been, but it’s invisible. That’s why it’s important to be vigilant about the fees that are being charged to your investments. And those big red slices are why I’m always banging the drum of “low fee index funds”.

Whenever I post something like this I hear someone say “Stop fear mongering, no one is being charged 2%”. Here’s a little story in response. Last week someone reached out to me and asked if I could help identify the fees they were being charged. They sent me a statement for a brokerage account with about $20,000 in it.

Here’s what I found. The $20K split across NINETEEN different actively managed mutual funds. The weighted average of those expense ratios was 0.6%. Not HORRIBLE, but not great. But that’s not the end. This individual investor was ALSO being charged a quarterly management fee. On an annual basis it added up to 1.38%. Add those together and you get total annual fees of 1.98%. (And don’t get me started about the tax inefficiency and underperformance they can expect from the bevy of actively managed funds in a taxable account).

The above story isn’t a case of outlandish and unusual fraud. It’s the status quo for many investors who stumble into a financial advisor’s office who offers to manage their investments for them. And you can see by the chart how devastating (yet invisible to the investor) the fees can be.

What do you? Learn to invest on your own. No one will care about your money as much as you. And if you do want to talk to an advisor, find an advice-only advisor who doesn’t manage your investments for an annual fee. Rather they help you set up your investments and provide advice for a flat fee.

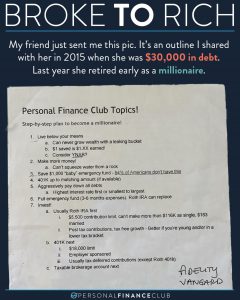

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!