You know me, I’m not one to have a flair for the dramatic or to make broad sweeping generalizations with outlandish headlines. Yet here we are. But in this case I think it’s warranted.

Here’s the situation. There’s a sector of the financial services industry that preys on teachers. They show up to your school, maybe even offer free food in the teacher’s lounge. They email you. They offer free financial advising sessions, or help planning for your retirement. They might even have confusing company names or pitches that make it sound like they’re there on behalf of your state funded pension plan to help.

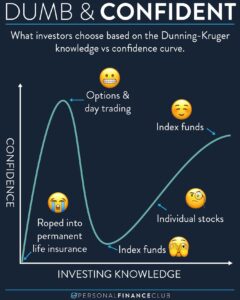

Here’s the reality. They’re insurance salesmen. They work on commission. They push crappy high fee, underperforming products. The garbage they try to sell you will drain your bank account and ruin your chance at the kind of investment growth that can give you a wealthy (possibly early) retirement.

I have a friend who is a teacher. When she was 25 one such “financial advisor” came to her school. Thinking she was doing the right thing, she started putting $500/month of her limited teacher salary into the product he recommended. It was a high-fee annuity. 10 years later when I saw it, she had paid in about $60,000 and it was worth much less than that. She would have been better off putting that $500 under her mattress. If she actually invested it in an index fund over those 10 years she would have over $100,000 and growing. If she kept going beyond 10 years the gap would have gotten exponentially wider.

That story, while anecdotal, is representative of EVERY story I have heard about teachers getting pitched financial advice in schools, so please beware!

If you’re a teacher or know a teacher, please share this with them! A great resource to help is @403bwise (403bwise.org). I was recently on their great podcast called “Teach and Retire Rich” which you should also check out. They’re doing great work and can help you find the best 403b providers for your district.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!