I got married! And yes, we did the whole thing for $294! This was obviously a courthouse wedding. Just the two of us went one afternoon. We didn’t even have a witness so they hit us for the $58 witness upgrade. We still plan to have a party late next year, but we wanted to get the paperwork out of the way sooner, so we did it this way! And guess what! It worked. We’re just as married as the next couple.

My WIFE’S name is Andrea. She’s a lawyer. She’s smart, and kind, and thoughtful, and hardworking, and caring, and beautiful! She’s also not really into social media or hyper-financial-transparency like I am. You probably won’t see too much of her around here, and I’ll be running any shared financial info by her before I share it with the world. But you can trust I’m very happy.

I know talk about weddings and money can get everyone bent out of shape, so I’d like to include the disclaimer that what WE DID is not what YOU have to do. You can do whatever you want! But weddings sure can be expensive. The average wedding cost in 2024 is $33,000 (According to US News/Zola). If you were to get married at 30 and had $33K to spend on a wedding, but instead decided to go to the courthouse, that would leave you with $32,706. If you INVEST that money for 35 years until you’re 65 at a 10% rate of return, you’ll be left with over $919,000. A pretty sizable chunk of your entire retirement fund, just for bypassing a big one day party.

Should you do that? I don’t know. It’s up to you. I think weddings can make for great memories and bring friends and family together who might never otherwise see each other. But they can also vary DRAMATICALLY in price. And things can quickly get VERY EXPENSIVE with you utter the word “wedding” to a vendor. So when you’re burning that money on your wedding, keep in mind the tradeoffs you’re making. A little disciplined frugality for a one day event could leave you hundreds of thousands of dollars richer down the road.

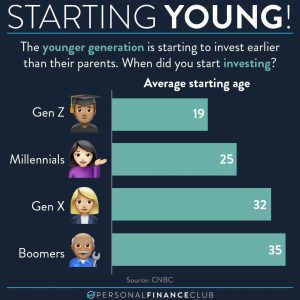

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!