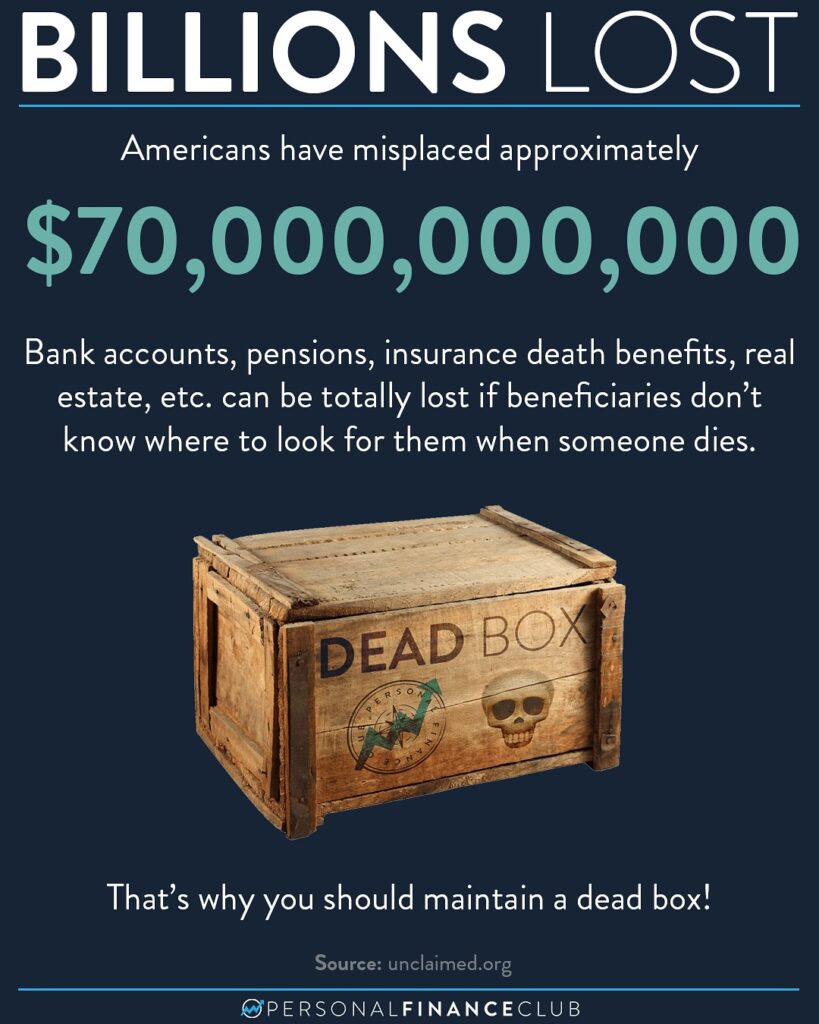

The response to the dead box has been amazing! Last I checked we’ve had over 2,500 sign up. I’ve been getting a ton of questions, so I’ll try to answer them here:

• Do I need to buy multiple for me and my family? No, you can just buy it once and reuse the template for whoever needs it. I’m not Netflix cracking down on sharing over here.

• Does it work if I’m not in the US? Yes! This isn’t tied to location at all so it works wherever you live.

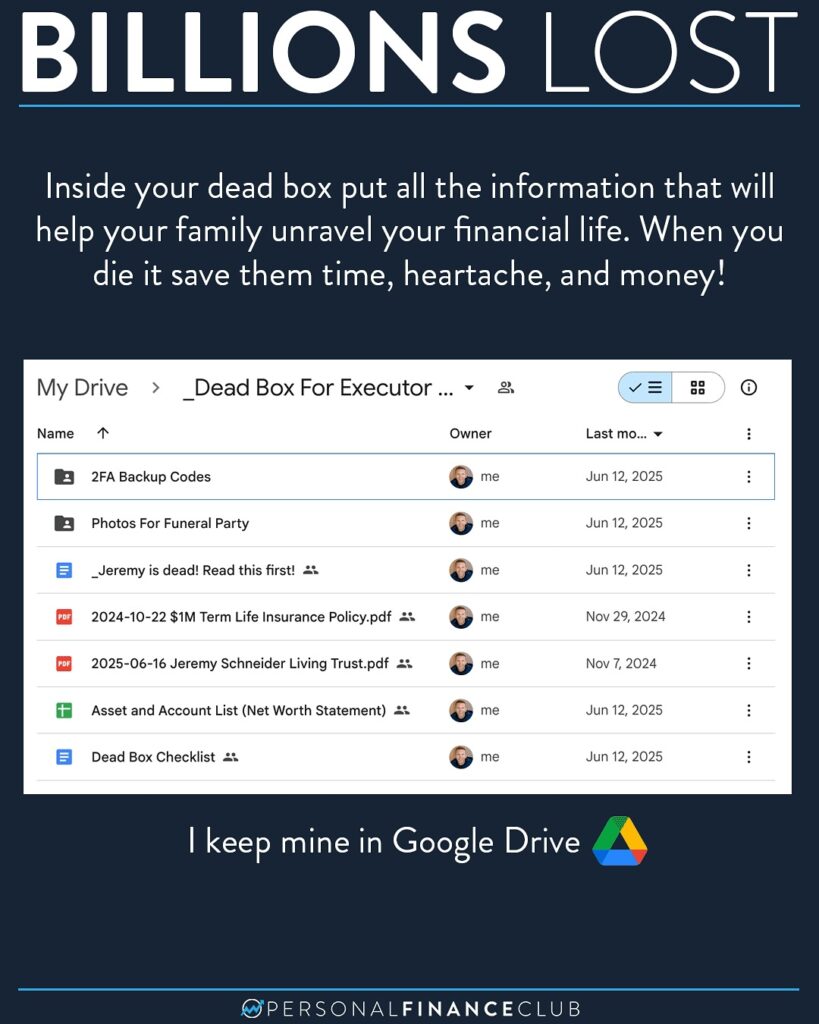

• Is it secure? We don’t actually store your files, rather we’re providing templates in Google Drive or Word / Excel format. How you secure it is up to you. I keep mine in Google Drive and keep it secure using a unique strong password, a password manager app, and multifactor authentication. Any time you’re putting any sensitive information online, or even using email (which can be used to get into your other accounts) you need to keep it secure!

• What’s with these live trainings? We’re having two but they’re both the same. We’ll cover the dead box, wills and trusts, security, password managers, other popular topics, and answering your questions. The link to sign up is in your account after you sign up and we’ll send out an email with the sign upon Monday too!

• Can I print this and do put it in a physical box? Sure, although it’s not really designed to be printer friendly. But you could totally use the kit as your guide, write your letter, fill out your net worth statement, print it, write on it, etc and use it in a physical dead box.

• Why you gotta call it DEAD, that’s so crude. I’m not really into euphemisms. If we call it what it is, maybe it’s a little bit less taboo and we can actually get to work.

Thanks everyone for taking your legacy seriously. I hope NO ONE READING THIS DIES but once we all do, an up to date dead box will be an amazing gift to your family.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!