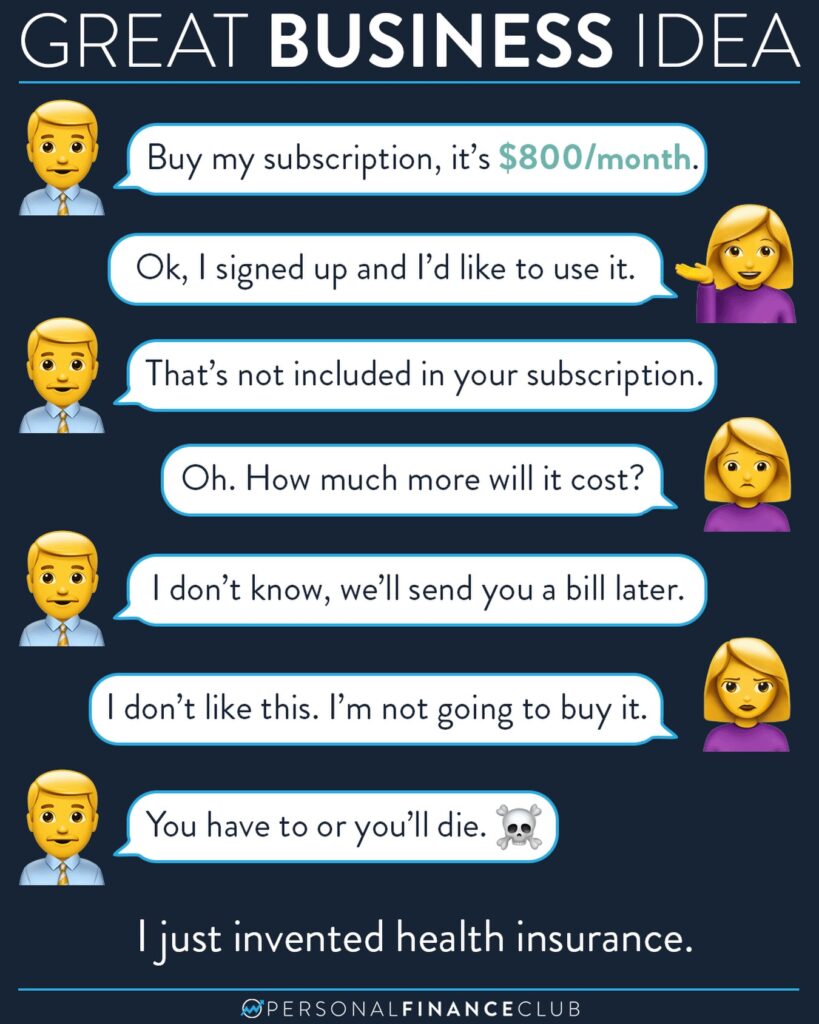

What other industry exists where neither the consumer NOR the service provider knows the COST of the service at the time of purchase? It’s a really wild experience that you go to a doctor, potentially for life saving care, and neither you NOR the doctor know what it’s going to cost. It’s rough.

I don’t pretend to have a solution to health care in the US. It’s one of those extremely complex and messy problems that has no simple answer. But I often get asked about health insurance in the context of early retirement. If you don’t have a job that provides health insurance, how can you possibly retire!?

Here’s what I do: I buy it. Love it or hate it, Obamacare standardized the public market for health insurance so that everyone can get covered and it includes certain critical features, like an annual out-of-pocket max, and no lifetime caps on coverage. But it also isn’t cheap.

When I was single buying it for myself, it was about $400/month. Now, as a family of four our coverage is about $1,400/month. Ouch!

But, while it’s a lot of money, it’s still just an amount of money. It’s up there in scale with housing, transportation, food, etc. These are things I need to cover if I’m going to quit my job, which is exactly what I do.

I primarily cover those costs from my investments. These days I have about $4M invested in the stock market and real estate. Assuming a 4% “safe withdrawal rate”, that gives me about $160K I can pull from my investments (via dividends and selling shares) to cover my expenses each year. It’s enough to pay for health insurance and my other expenses.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!