In this chart, I’m giving IULs way too much credit. I’m assuming they have zero commission fees, zero cost of insurance, 100% participation rate, zero annual fee, etc, etc. I suspect if we looked at a typical policy the final value for the IUL would be less than half of what’s shown here.

If you’re not familiar with IULs, it’s an insurance product that is often sold to unsuspecting young investors as an investment by insurance salesmen using the title “financial advisor”. The insurance salesmen will tout all sorts of fantastic benefits like risk free growth (IULs lose value to fees for many years before they even break even), tax-free inheritance (your first $11M you pass on is tax free anyway), and “unlimited banking” (where you borrow your own money for yet another fee).

IULs work like this: You pay a premium, some of which goes towards the cost of life insurance, more of which is taken in fees. What’s left is added to a “cash value” associated with the policy. Each year that cash value will grow keying off a stock market index, like the S&P 500. If the S&P 500 goes down, say -6% like it did in 2018, the IUL cash value is safe with a 0% floor. If the S&P 500 goes up, the cash value increase by that percent with a cap, like 12%. For example, last year the S&P 500 was up 16%, but the IULs growth is capped at 12%.

That doesn’t sound too bad. 0% floor, 12% potential! Why not?! Well, a couple things. First, these IULs ignore the existence of dividends. They look at just the change in share price of the S&P 500. If you actually own an S&P 500 index fund, you get the change in share price, PLUS you get the dividends which can be reinvested. Second, this 0%/12% game is basically a parlor trick to make it sound like you always win, but you don’t. In the last 40 years, the S&P 500 was up 31 years. 21 of those were greater than 12%, averaging almost 22%. It turns out missing out on the huge growth hurts you way more than the 0% downside helps.

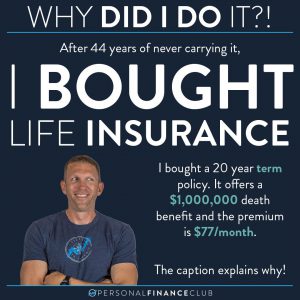

I would never purchase any sort of permanent life insurance. If you need life insurance, buy term, and invest the rest.

-Jeremy

via Instagram

September Sale!

September Sale!