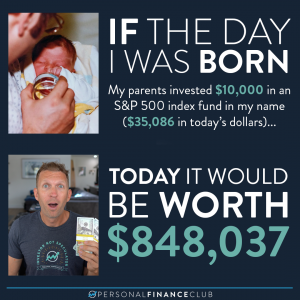

At the end of 2021, my index fund investments were worth about $3,057,000. As of today, that number is $2,778,000. That’s a drop of $279,000 or about 9%. While seeing these numbers on a website go down isn’t exactly my favorite thing, it absolutely doesn’t matter. Why? Because I’m not selling my shares. So who cares what people are currently willing to pay for them! I’m planning to hold for decades and I still have supreme confidence that the companies of the world will continue to pump value back to the shares that I own. For those looking to build serious wealth, this short term volatility should absolutely be ignored.

Warren Buffett has never written a book, but he does write annual letters to the shareholders of his company Berkshire Hathaway. They were compiled into a very long book which is 97% dry boring accounting talk and 3% charming folksy analogies. One of my favorites is when he compares buying stocks to buying a physical property. I’ll try to summarize it here:

Let’s say you buy a farm for $100,000. You carefully looked at the crop yield, costs, crop prices, etc and decided this farm will produce a handsome $15,000/year profit. Your plan is to own it for years, and use that profit to expand your business further. A few weeks into your farm ownership, a crazy neighbor from across the street pokes his head out the window and screams “HEY! I’LL GIVE YOU $80,000 FOR YOUR FARM!” What would you do? Hang your head in despair, crippled by the fact that you lost $20,000? Or would you continue with your plan to profit and expand your investment? I hope the latter.

So if your plan is to accumulate shares of the profitable businesses of the world (in the form of index funds) and hold and expand for decades, the wild rantings of the manic-depressive market whose bouts of irrational exuberance and crippling pessimism that drive the daily prices should be of no concern to you. Ignore the noise. Stick to the plan. Accumulate shares. Build wealth over time.

As always, reminding you to build wealth by following the two PFC rules: 1.) Don’t invade sovereign democratic nations and 2.) Don’t succumb to hateful propaganda.

-Jeremy

via Instagram

September Sale!

September Sale!