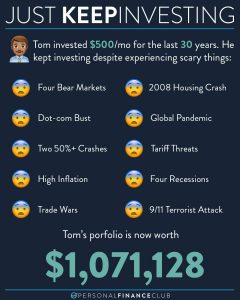

I was watching the Netflix documentary “Get Smart With Money” a few days ago. On it @imrossmac was coaching @teez on getting starting with investing in an index fund. Teez asked what if the index fund goes down? Ross wisely responded that there is no “if”. They WILL go down. That’s part of investing. The stock market has provided a remarkable 10% annualized return over the last 100 years. But that doesn’t come with a guarantee. In order to realize that gain, you have to be willing to ride out the inevitable volatility to reap those rewards. The stock market is three steps forward, one step back. If you can’t handle the one step back, you’re gonna miss all the progress.

When reflecting on that, I thought about PFC’s own logo. I made it in early 2019 when the market had PRETTY MUCH gone straight up for 11 straight years. (2018 was slightly down, but only about 4%). But I knew then that it wouldn’t last. Bumps will always be ahead in the road. And that’s why the logo is a jagged upward arrow, not a smooth exponential curve.

Tuesday we had the worst single day drop since the crazy pandemic market of 2020. -4% in a single day! Ouch! But, again, that’s part of the deal. I’m sleeping like a baby because I’m not even CONSIDERING selling anything. I’ll hold for years and decades and these bumps in the road will be way behind us, and the market will be again setting record highs.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram

September Sale!

September Sale!