US vs International Stocks: Which Performs Better?

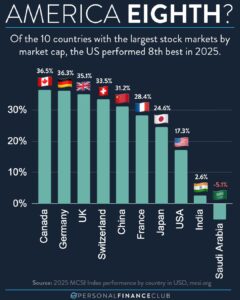

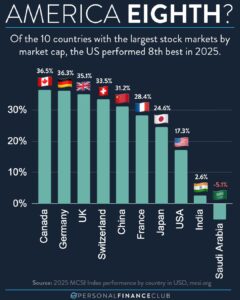

Some investors think you should only invest in the US stock market. Their reasoning? The US stock market performs the best, so why would you

New Year 2026 Sale!

New Year 2026 Sale!

Some investors think you should only invest in the US stock market. Their reasoning? The US stock market performs the best, so why would you

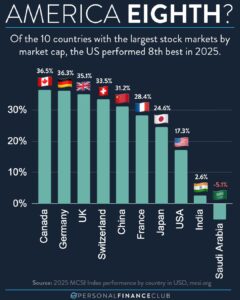

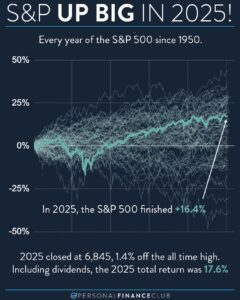

2025 was a great year for the stock market! We always talk about how the stock market “returns 10% per year”, but in reality it

I can imagine the conversation surrounding the creation of these ETFs by the Truth Social team. I assume it went something like this: Boss: “Hey,

When our kids are a bit older, we’ll involve them more in these decisions. Once they understand the concept of money and spending, we’ll have

I really don’t want to die any time soon. But if I DO, I really don’t want to leave my family with a financial mess.

Investing is SO powerful but can also be SO intimidating if you’re new to it. But the GOOD news is that doing it well is

The one piece of advice I can offer to investors that is most likely to make you the most money is this: You don’t know

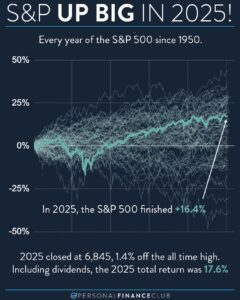

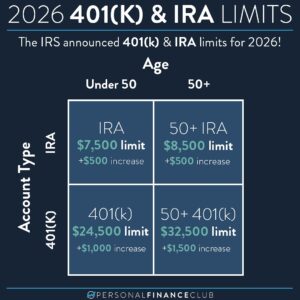

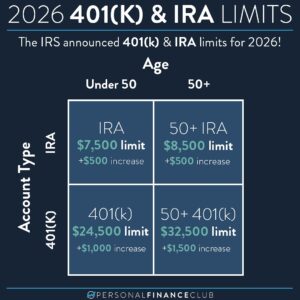

Every year the IRS updates the rules on how much you’re allowed to contribute to your IRA and 401(k) accounts based on inflation and cost

It’s true, the US isn’t making any more pennies. They’ll still be around for a while as there are about 250 billion pennies out there

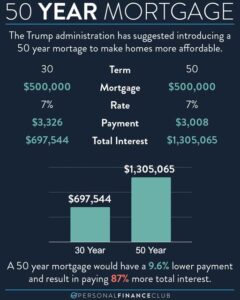

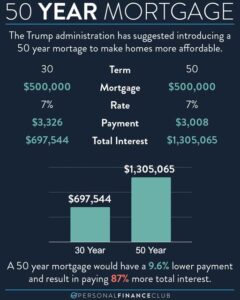

The numbers are eye watering. If you were to borrow $500K at 7% interest on a 50 year term, you would end up paying over

Some investors think you should only invest in the US stock market. Their reasoning? The US stock market performs the best, so why would you

2025 was a great year for the stock market! We always talk about how the stock market “returns 10% per year”, but in reality it

I can imagine the conversation surrounding the creation of these ETFs by the Truth Social team. I assume it went something like this: Boss: “Hey,

When our kids are a bit older, we’ll involve them more in these decisions. Once they understand the concept of money and spending, we’ll have

I really don’t want to die any time soon. But if I DO, I really don’t want to leave my family with a financial mess.

Investing is SO powerful but can also be SO intimidating if you’re new to it. But the GOOD news is that doing it well is

The one piece of advice I can offer to investors that is most likely to make you the most money is this: You don’t know

Every year the IRS updates the rules on how much you’re allowed to contribute to your IRA and 401(k) accounts based on inflation and cost

It’s true, the US isn’t making any more pennies. They’ll still be around for a while as there are about 250 billion pennies out there

The numbers are eye watering. If you were to borrow $500K at 7% interest on a 50 year term, you would end up paying over