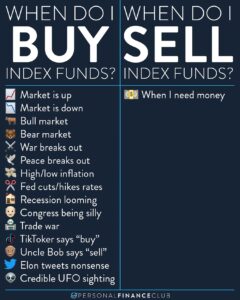

How to build wealth by buying through the highs and lows

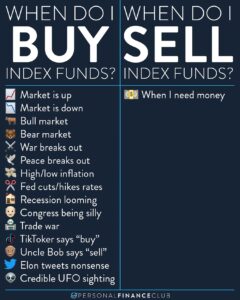

“Buy low, sell high” is some of the worst advice in investing. It implies that you, the investor, is somehow supposed to nimbly navigate the

Black Friday Sale!

Black Friday Sale!

“Buy low, sell high” is some of the worst advice in investing. It implies that you, the investor, is somehow supposed to nimbly navigate the

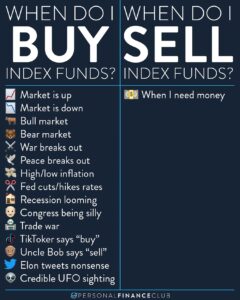

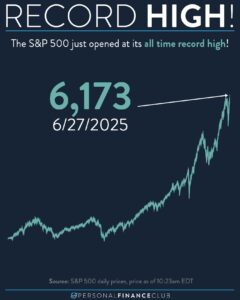

I feel like I’m writing this statement for the thousandth time since I started Personal Finance Club, but here it goes again. “Just a few

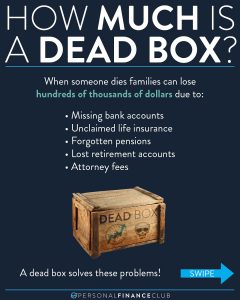

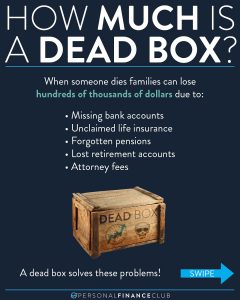

The response to the dead box has been amazing! Last I checked we’ve had over 2,500 sign up. I’ve been getting a ton of questions,

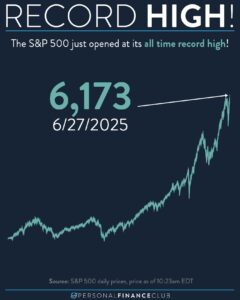

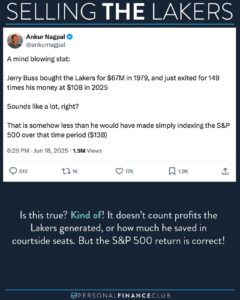

A ton of people have been sending me this, originally written by @ankurna, asking if it’s true. Did this INSANELY GOOD investment in the LA Lakers

Thank you to everyone in the clurb! Someone just asked me how many followers we have across platforms, and I didn’t know so I added

I also keep a letter in my dead box. Partially heartfelt, mostly logistical with lots of instructions like where to find keys, entry codes, access

Yeah, I know, where are you gonna get the extra $1,658/month to make those huge payments? Well here’s the good news, you only need to

I created my own dead box back in 2018 when I realized I had a pretty significant amount of money, and if I were to

Happy Father’s Day to all the dads out there from a first time dad! As always, reminding you to build wealth by following the two

“Buy low, sell high” is some of the worst advice in investing. It implies that you, the investor, is somehow supposed to nimbly navigate the

I feel like I’m writing this statement for the thousandth time since I started Personal Finance Club, but here it goes again. “Just a few

The response to the dead box has been amazing! Last I checked we’ve had over 2,500 sign up. I’ve been getting a ton of questions,

A ton of people have been sending me this, originally written by @ankurna, asking if it’s true. Did this INSANELY GOOD investment in the LA Lakers

Thank you to everyone in the clurb! Someone just asked me how many followers we have across platforms, and I didn’t know so I added

I also keep a letter in my dead box. Partially heartfelt, mostly logistical with lots of instructions like where to find keys, entry codes, access

Yeah, I know, where are you gonna get the extra $1,658/month to make those huge payments? Well here’s the good news, you only need to

I created my own dead box back in 2018 when I realized I had a pretty significant amount of money, and if I were to

Happy Father’s Day to all the dads out there from a first time dad! As always, reminding you to build wealth by following the two