What to do with your year-end bonus

It’s almost the end of the year, and some lucky folks are getting year end bonuses! Or maybe you have come into some other infusion

New Year 2026 Sale!

New Year 2026 Sale!

It’s almost the end of the year, and some lucky folks are getting year end bonuses! Or maybe you have come into some other infusion

I don’t talk about credit score much, because compared to building wealth it doesn’t matter much. It is MUCH better to have a lot of

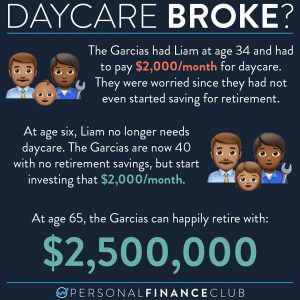

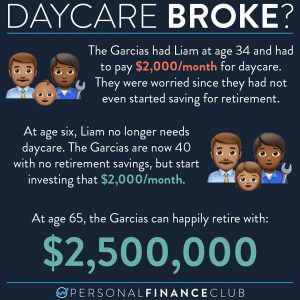

The cost of daycare is outrageous. It hurts my heart to think of the financial strain it puts on young families. I often hear from

People love the phrase “dollar cost averaging”. I’m not sure why, but I think because it sounds cool. But for the sake of this post,

The original idea behind timeshares was cool. You want to own a vacation home. But naturally, you’ll only spend part of the year there. So

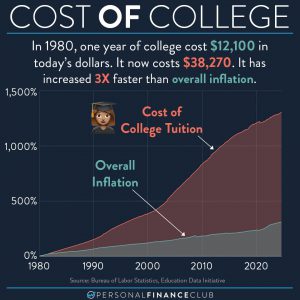

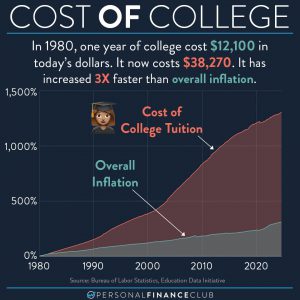

The US has found itself in an unplanned and unintended arms race of college tuition. It started innocently enough. In 1950 the cost of tuition

I’ve been hearing this sentiment a lot lately. “I don’t want to invest now when the market is at record highs”. Actually, I’ve heard that

People get mad at me whenever I mention renting or buying. I’ll say something like “In addition to the mortgage payment, there are costs associated

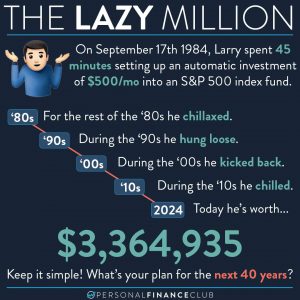

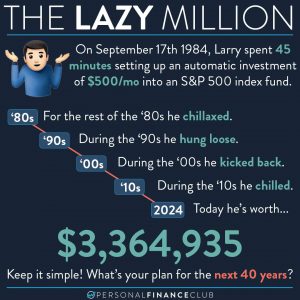

I often use a 40 year time horizon in my examples. I do this because a typical working career is around 40 years, and it’s

Let’s not forget what investing really is. It’s buying and holding assets that provide an income stream and go up in value over time. Namely

It’s almost the end of the year, and some lucky folks are getting year end bonuses! Or maybe you have come into some other infusion

I don’t talk about credit score much, because compared to building wealth it doesn’t matter much. It is MUCH better to have a lot of

The cost of daycare is outrageous. It hurts my heart to think of the financial strain it puts on young families. I often hear from

People love the phrase “dollar cost averaging”. I’m not sure why, but I think because it sounds cool. But for the sake of this post,

The original idea behind timeshares was cool. You want to own a vacation home. But naturally, you’ll only spend part of the year there. So

The US has found itself in an unplanned and unintended arms race of college tuition. It started innocently enough. In 1950 the cost of tuition

I’ve been hearing this sentiment a lot lately. “I don’t want to invest now when the market is at record highs”. Actually, I’ve heard that

People get mad at me whenever I mention renting or buying. I’ll say something like “In addition to the mortgage payment, there are costs associated

I often use a 40 year time horizon in my examples. I do this because a typical working career is around 40 years, and it’s

Let’s not forget what investing really is. It’s buying and holding assets that provide an income stream and go up in value over time. Namely