Why the S&P 500 isn’t enough: the case for international investing

I talk a lot about the S&P 500. The main reason is it has a very long track record with readily available public data. It

New Year 2026 Sale!

New Year 2026 Sale!

I talk a lot about the S&P 500. The main reason is it has a very long track record with readily available public data. It

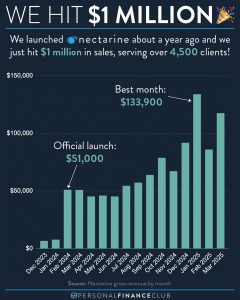

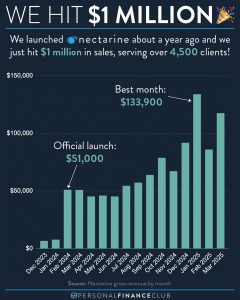

Vivi, Shane, and I officially started a million dollar business! It’s so cool to be working on something we believe in so passionately, we think

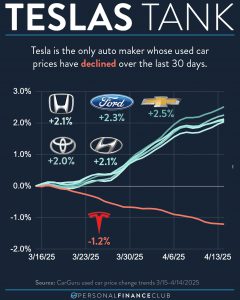

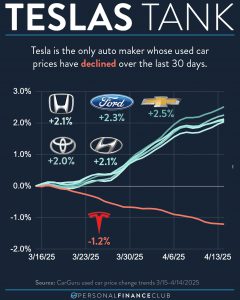

My social media scrolling has recently shown me a lot of videos of Tesla owners trading in their cars for another brand, apparently to voice

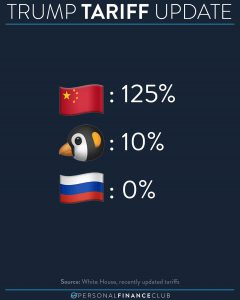

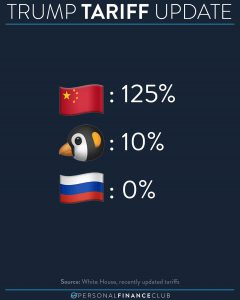

The concept of a tariff isn’t always bad. Some countries have used them to great success for focused purposes. @planetmoney just had a great episode highlighting how

For non-flag enthusiasts, those three countries in order are: China, Heard and McDonald Islands, and Russia. Admittedly, Heard and McDonald Islands is an uninhabited island

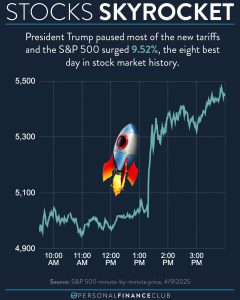

Over the last few days I’ve heard a lot of sentiment like “I’m going to stay out of the market until it stops falling”. And

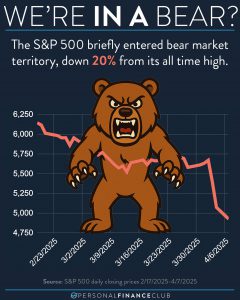

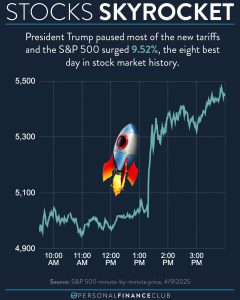

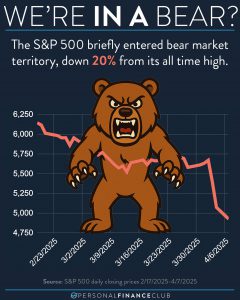

You may have heard it’s been a bit of a volatile few days in the stock market. Yesterday, a tweet that said President Trump was

AS I WRITE THIS, the market opened up way down, dropped more well into bear market territory but now is UP about 1% from it’s

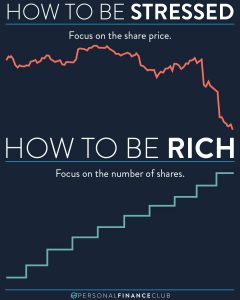

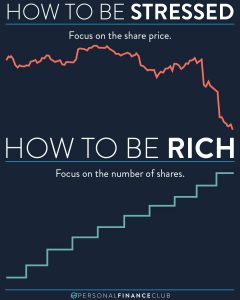

I get it. It’s scary to check your investment accounts and see the value go down. I’m personally down over a quarter million bucks over

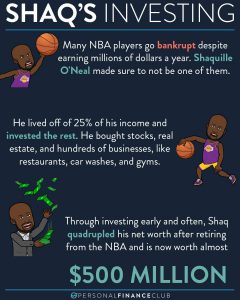

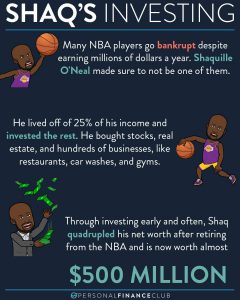

When Shaq got his first million dollar check at age 20, he spent it ALL in one day. He quickly learned that his life would

I talk a lot about the S&P 500. The main reason is it has a very long track record with readily available public data. It

Vivi, Shane, and I officially started a million dollar business! It’s so cool to be working on something we believe in so passionately, we think

My social media scrolling has recently shown me a lot of videos of Tesla owners trading in their cars for another brand, apparently to voice

The concept of a tariff isn’t always bad. Some countries have used them to great success for focused purposes. @planetmoney just had a great episode highlighting how

For non-flag enthusiasts, those three countries in order are: China, Heard and McDonald Islands, and Russia. Admittedly, Heard and McDonald Islands is an uninhabited island

Over the last few days I’ve heard a lot of sentiment like “I’m going to stay out of the market until it stops falling”. And

You may have heard it’s been a bit of a volatile few days in the stock market. Yesterday, a tweet that said President Trump was

AS I WRITE THIS, the market opened up way down, dropped more well into bear market territory but now is UP about 1% from it’s

I get it. It’s scary to check your investment accounts and see the value go down. I’m personally down over a quarter million bucks over

When Shaq got his first million dollar check at age 20, he spent it ALL in one day. He quickly learned that his life would