The US economy is booming!

If you showed any economist these five major economic indicators and asked them to describe how this economy is doing, I’m pretty sure they would

If you showed any economist these five major economic indicators and asked them to describe how this economy is doing, I’m pretty sure they would

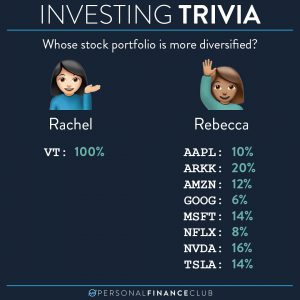

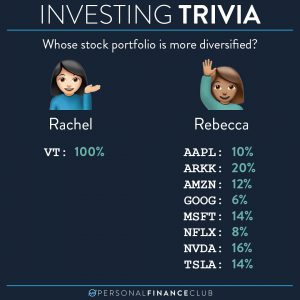

This trivia question gets at a confusion I see a lot among newer investors. Investors will ask something like “I have a target date index

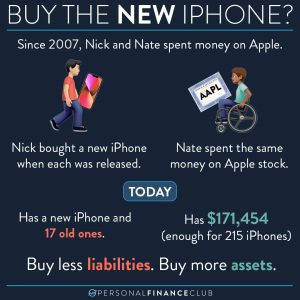

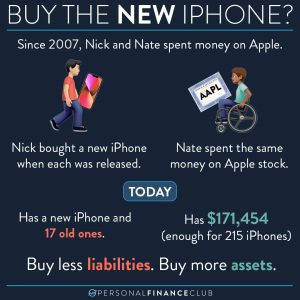

I actually did all the math on this. I looked up the date of each iPhone release going back to 2007, the price of each

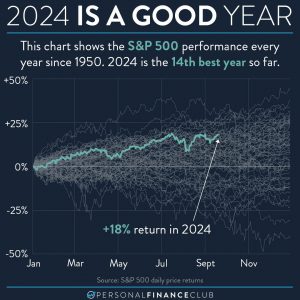

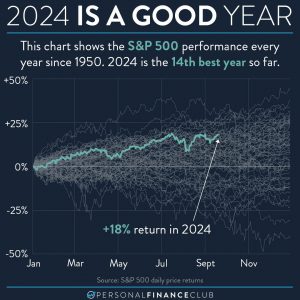

We hit the 39th record high of the year yesterday! Prior to 2024, we went almost two years with no record highs. We keep hearing

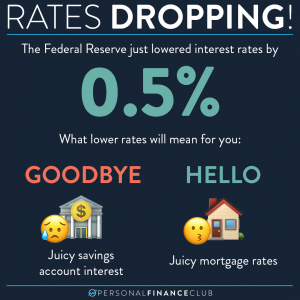

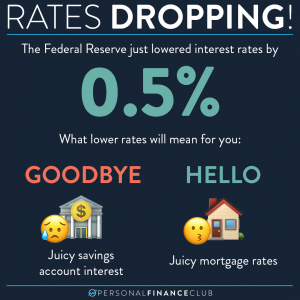

Jerome Powell is the chair of the Federal Reserve. One of his jobs is deciding at what interest rate banks can borrow money from the

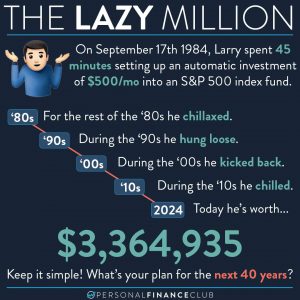

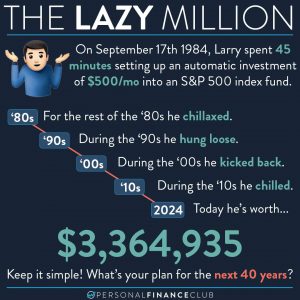

Let’s not forget what investing really is. It’s buying and holding assets that provide an income stream and go up in value over time. Namely

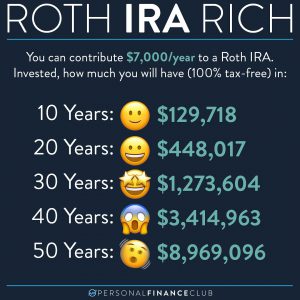

If you’re new to investing, the steps to do this are pretty simple. You do the following: • Open an account at at website like

THIS IS CONFUSING, I know. But after days of contemplation and hours of graphic design, this is the best way I know to show what’s

Does this mean the stock market will continue to go up?? WHO KNOWS. There will be plenty of people who tell you it can’t keep

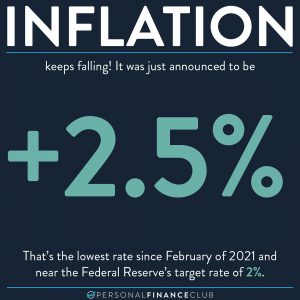

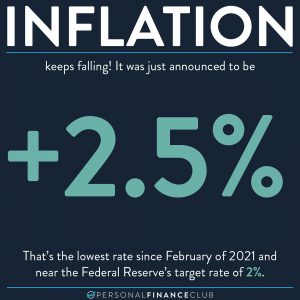

A few quick notes on inflation: 1.) Inflation being low doesn’t mean prices are going to drop. It just means they aren’t going up as

If you showed any economist these five major economic indicators and asked them to describe how this economy is doing, I’m pretty sure they would

This trivia question gets at a confusion I see a lot among newer investors. Investors will ask something like “I have a target date index

I actually did all the math on this. I looked up the date of each iPhone release going back to 2007, the price of each

We hit the 39th record high of the year yesterday! Prior to 2024, we went almost two years with no record highs. We keep hearing

Jerome Powell is the chair of the Federal Reserve. One of his jobs is deciding at what interest rate banks can borrow money from the

Let’s not forget what investing really is. It’s buying and holding assets that provide an income stream and go up in value over time. Namely

If you’re new to investing, the steps to do this are pretty simple. You do the following: • Open an account at at website like

THIS IS CONFUSING, I know. But after days of contemplation and hours of graphic design, this is the best way I know to show what’s

Does this mean the stock market will continue to go up?? WHO KNOWS. There will be plenty of people who tell you it can’t keep

A few quick notes on inflation: 1.) Inflation being low doesn’t mean prices are going to drop. It just means they aren’t going up as