Announcing the 30 Day Instagram Day Trading Challenge!

As part of the charitable mission of Personal Finance Club, we donate 20% of our sales to charity each month. Last month we had $110,129

New Year 2026 Sale!

New Year 2026 Sale!

As part of the charitable mission of Personal Finance Club, we donate 20% of our sales to charity each month. Last month we had $110,129

This year has been kind of a rocky ride for the stock market. There’s been at least 5 times where the market has had a

Those of you who have followed me for a while know that my FAVORITE way to invest is in a target date index fund! It’s

Dipping a toe into the world of investing for the first time can be extremely intimidating. Images dance in your head of wall street traders

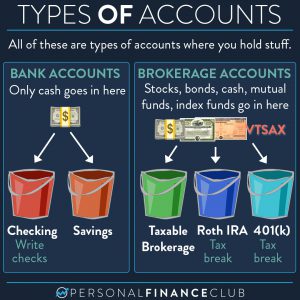

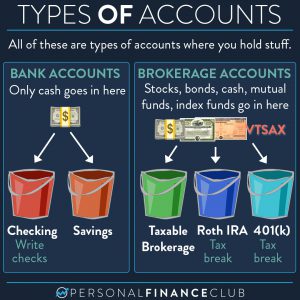

The most common confusion I see in investing is around the names of accounts. Roth IRA, 401(k), brokerage accounts, etc. They all sound so confusing!

The US government defines “full retirement age” as 67. If you go to high school and college you’ll probably graduate around 22. That leaves a

First of all, I’d like to be clear that those bags on the left are full of rice, not blow, so save your comments you

If you have $100,000 to invest and you go to a financial advisor who charges a 2% fee, they’ll take $2,000 per year. That’s a

Your eyes do not deceive you. The S&P 500 has had a cumulative annual growth rate of about 11.1% over the last 35 years. And

If you invested $1,000 in 1900 in an S&P 500 index fund, today it would be worth over $103,000,000. Well, that’s not possible for a

As part of the charitable mission of Personal Finance Club, we donate 20% of our sales to charity each month. Last month we had $110,129

This year has been kind of a rocky ride for the stock market. There’s been at least 5 times where the market has had a

Those of you who have followed me for a while know that my FAVORITE way to invest is in a target date index fund! It’s

Dipping a toe into the world of investing for the first time can be extremely intimidating. Images dance in your head of wall street traders

The most common confusion I see in investing is around the names of accounts. Roth IRA, 401(k), brokerage accounts, etc. They all sound so confusing!

The US government defines “full retirement age” as 67. If you go to high school and college you’ll probably graduate around 22. That leaves a

First of all, I’d like to be clear that those bags on the left are full of rice, not blow, so save your comments you

If you have $100,000 to invest and you go to a financial advisor who charges a 2% fee, they’ll take $2,000 per year. That’s a

Your eyes do not deceive you. The S&P 500 has had a cumulative annual growth rate of about 11.1% over the last 35 years. And

If you invested $1,000 in 1900 in an S&P 500 index fund, today it would be worth over $103,000,000. Well, that’s not possible for a