Is it too late to start to investing?

I often get asked “is it too late to start?”. Once someone DM’d me asking me this. I asked him how old he was and

New Year 2026 Sale!

New Year 2026 Sale!

I often get asked “is it too late to start?”. Once someone DM’d me asking me this. I asked him how old he was and

Don’t get me wrong. I’m an academic and money nerd at heart so I love to geek out on all the stuff on the left

I talk a lot about the mechanics of investing. Roth IRAs, index funds, lower fees, compound growth, BLAH BLAH BLAH. But at the end of

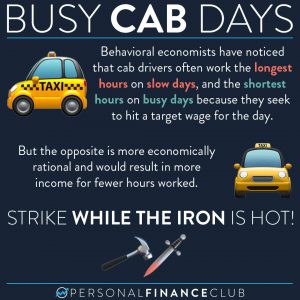

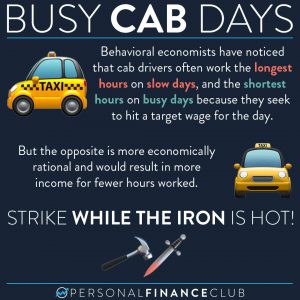

I don’t particularly like selling. (I’m gonna tie this in with cabs by the end, I promise). When I created my course back in 2020

My investment strategy is SO boring an SO easy. I talk about investing all the time, but I almost NEVER actually DO anything. I started

I’d like to start by saying that my mom is NOT BROKE. I called her to fact check this post, and she was very concerned

Happy Mother’s Day to all those working mom’s whether they’re working in and/or out of the home! The spouse that brings in the income usually

Compound growth is such a beautiful thing when you let time work on your side. Saving $7,000 a year might not seem like it could

I’ve heard from life insurance salesmen that their commission to make a sale is around the ENTIRE first year of premiums. i.e. if you sign

I wish I could tell you how to double your money in the stock market in a month. I wish I could tell you which

I often get asked “is it too late to start?”. Once someone DM’d me asking me this. I asked him how old he was and

Don’t get me wrong. I’m an academic and money nerd at heart so I love to geek out on all the stuff on the left

I talk a lot about the mechanics of investing. Roth IRAs, index funds, lower fees, compound growth, BLAH BLAH BLAH. But at the end of

I don’t particularly like selling. (I’m gonna tie this in with cabs by the end, I promise). When I created my course back in 2020

My investment strategy is SO boring an SO easy. I talk about investing all the time, but I almost NEVER actually DO anything. I started

I’d like to start by saying that my mom is NOT BROKE. I called her to fact check this post, and she was very concerned

Happy Mother’s Day to all those working mom’s whether they’re working in and/or out of the home! The spouse that brings in the income usually

Compound growth is such a beautiful thing when you let time work on your side. Saving $7,000 a year might not seem like it could

I’ve heard from life insurance salesmen that their commission to make a sale is around the ENTIRE first year of premiums. i.e. if you sign

I wish I could tell you how to double your money in the stock market in a month. I wish I could tell you which