America turns 247 years old

This past year has been a rollercoaster. The items on the list only cover a small handful of what happened in the past year of America’s

New Year 2026 Sale!

New Year 2026 Sale!

This past year has been a rollercoaster. The items on the list only cover a small handful of what happened in the past year of America’s

A couple weeks ago I bought the watch on the right. These are the actual product images and actual prices as listed on Amazon. It’s

It was just released that the Supreme Court voted 6-3 against federal student loan forgiveness. This decision has been months in the making and will

When you procrastinate in college, you’ll still graduate with the same degree. But in the case of investing, procrastination could cost you a MILLION dollars.

The worst part about the super high costs of healthcare in the US is that it limits access to many people who need help. Even with

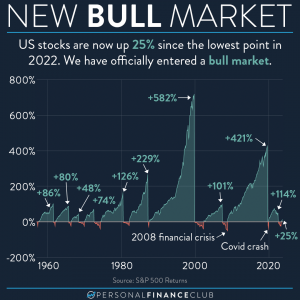

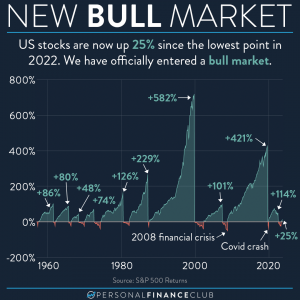

US stocks spent most of last year in a bear market but they are officially back in a bull market as of last week. What

After we had a down year in 2022, ALL I HEARD was how it was a bad time to invest. A recession is looming! Interest

Will your luck ever be so bad that you exactly miss the 20 best days in the stock market? Probably not. But trying to pick

Money can be a very emotional and sensitive topic. People often feel shame around debt, feel behind in investing, feel anxiety around budgeting, etc. But

Over the last 100 years, the stock market returned about 10% annually. That means if you have $148,000 invested, you can expect to earn (on

This past year has been a rollercoaster. The items on the list only cover a small handful of what happened in the past year of America’s

A couple weeks ago I bought the watch on the right. These are the actual product images and actual prices as listed on Amazon. It’s

It was just released that the Supreme Court voted 6-3 against federal student loan forgiveness. This decision has been months in the making and will

When you procrastinate in college, you’ll still graduate with the same degree. But in the case of investing, procrastination could cost you a MILLION dollars.

The worst part about the super high costs of healthcare in the US is that it limits access to many people who need help. Even with

US stocks spent most of last year in a bear market but they are officially back in a bull market as of last week. What

After we had a down year in 2022, ALL I HEARD was how it was a bad time to invest. A recession is looming! Interest

Will your luck ever be so bad that you exactly miss the 20 best days in the stock market? Probably not. But trying to pick

Money can be a very emotional and sensitive topic. People often feel shame around debt, feel behind in investing, feel anxiety around budgeting, etc. But

Over the last 100 years, the stock market returned about 10% annually. That means if you have $148,000 invested, you can expect to earn (on