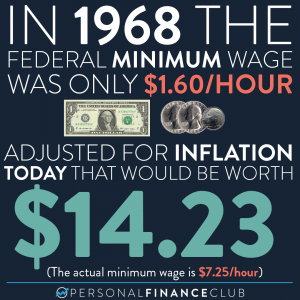

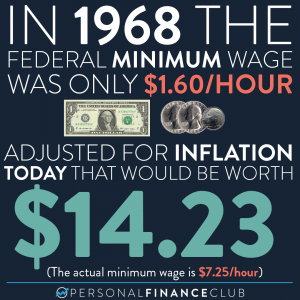

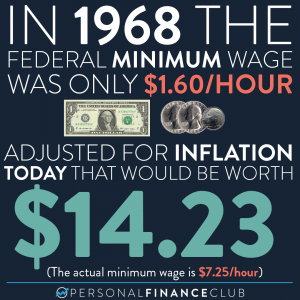

Minimum wage in 1968 vs 2023

I was working on another post, calculating how much money you need to have invested to be equivalent to working minimum wage for a year

New Year 2026 Sale!

New Year 2026 Sale!

I was working on another post, calculating how much money you need to have invested to be equivalent to working minimum wage for a year

Not everything is just about money. Yes, you would probably be able to save more money if you never got a pet. But the joy

Have you guys experienced this? I see it mostly scrolling through TikTok. I come across a live video of (usually) a guy standing in front

Borrowers of federal student loans have been enjoying no payments and no interest accumulating on their student loans. But, three years (and nine extensions) later,

I’ve seen a lot of sentiment this year about how it’s a “bad time to invest” and high yield savings accounts are paying so much,

If you work for a company that provides some sort of company stock as part of your compensation, you may find yourself with this issue.

We are on the brink of crossing $1 trillion in total credit card debt in the US. This type of debt is terrible. It has

If you only read the news, you’d expect the stock market to be way down this year. All we hear about is inflation, recession risk,

Investing is not complicated. It’s one of the areas of life where the simpler you make it, the better the result. But, many people do

BEFORE I jump into how to do this, if you haven’t already heard we are having a HUGE SALE on our two courses through next

I was working on another post, calculating how much money you need to have invested to be equivalent to working minimum wage for a year

Not everything is just about money. Yes, you would probably be able to save more money if you never got a pet. But the joy

Have you guys experienced this? I see it mostly scrolling through TikTok. I come across a live video of (usually) a guy standing in front

Borrowers of federal student loans have been enjoying no payments and no interest accumulating on their student loans. But, three years (and nine extensions) later,

I’ve seen a lot of sentiment this year about how it’s a “bad time to invest” and high yield savings accounts are paying so much,

If you work for a company that provides some sort of company stock as part of your compensation, you may find yourself with this issue.

We are on the brink of crossing $1 trillion in total credit card debt in the US. This type of debt is terrible. It has

If you only read the news, you’d expect the stock market to be way down this year. All we hear about is inflation, recession risk,

Investing is not complicated. It’s one of the areas of life where the simpler you make it, the better the result. But, many people do

BEFORE I jump into how to do this, if you haven’t already heard we are having a HUGE SALE on our two courses through next