Home prices have been shooting up much faster than inflation or people’s incomes. This has been happening for decades, but the last few years it got much worse. About three quarters of homebuyers say that buying a home in their area is not attainable.

The data in this graph is from a recent study from Clever. They compared the median home price with the overall level of inflation during the last 60 years. The numbers are from the US as a whole. Certain cities across the US, are dramatically worse than this.

Will homes one day become more affordable? Who knows. Either home prices need to fall. Or mortgage rates need to go down. Or incomes need to shoot higher. Unless one or multiple of those things happen, buying a house will continue to be very hard to do.

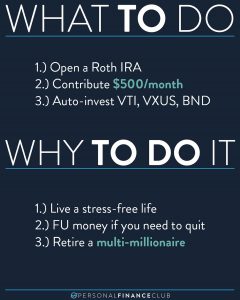

Don’t focus on what you can’t control. Spend your time and energy on things you can influence. Find ways to increase your income and keep investing as much as you can.

Do you know what has gone up much faster than either inflation OR home prices?? The stock market. One of the few ways to make sure your money grows faster than inflation AND faster than the home prices is by investing in the stock market or rental real estate.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane

September Sale!

September Sale!