This has been quite a rocky start to the year for the stock market. And I’ve heard that this drop FEELS DIFFERENT. But is it? Not according to an analysis of the market in the past. This chart and table show the largest intra-year drops of the S&P 500. It looks at during each year, from peak to trough, what’s the largest drop we experience. The AVERAGE drop for the last forty years is 12%! The 2022 drop so far? 10%, and we’re up today so far.

Note that this doesn’t mean the market ENDED the year down that much. For example, in 2020 we experienced a 34% intra-year drop, but the market recovered and ended UP over 16%.

Despite the AVERAGE intra-year drop being 12% over the last 40 years, the annualized return over that time period is a positive 11.5%. That means a $500/month over that time is now worth over $3.3 million!

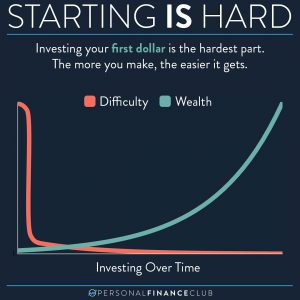

Stock market crashes and volatility are part of investing. If you want zero volatility, you can put your money in a savings account and get a 0.1% rate of interest. But for those of us who want to build wealth over the long term, we accept the volatility in the short term and are rewarded handsomely with a dramatically higher rate of return. Do you want high returns and low risk? That doesn’t exist. That means we only get the high returns in exchange for accepting this volatility.

Is the 10% drop we experienced over the last couple weeks going to be the worse we see this year? Or are we going to see another big one like in 1987, 2008, or 2020? I have no idea. If I could answer questions like that I’d be a billionaire not a millionaire. But I do know that buying and holding index funds guarantees you your fair share of all market growth. Buying assets that provide dividends and go up in value result in the wealth building magic of compound growth. Stay the course.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

More good research thanks to @shane_sideris on this one!

via Instagram

September Sale!

September Sale!