I’m not sure of the origin of this quote. I’ve seen it attributed as a “Wall Street Adage”. And to be fair, the analogy isn’t perfect. Because the bar of soap is always growing, but the more you touch it the slower it grows. But I love the idea!

I always come back to this idea that every instinct we have about investing is wrong. And we’re never actually TAUGHT best practices in any formal setting, so we’re left to rely on our instincts. And following our instincts is basically the worst thing we can do in investing.

WHAT IF, we went back in a time machine to January of 2020. And I told you we’re about to see a once in a century global pandemic. Entire economies would shut down for months. Supply chains would be devastated with shipping container freighters anchored outside of docks. What would you have guessed the stock market would do for the year of 2020? Would you have bet it would go down? I would have. Honestly, if a time traveler told me that I probably would have sold my entire portfolio and stayed in cash for a year.

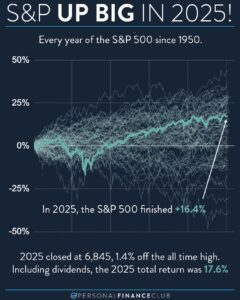

But guess what. The market was up 16% last year. And it’s up another 22% this year. So even if we HAVE IMPOSSIBLE KNOWLEDGE OF THE FUTURE, we STILL can’t guess the stock market right, what chance do we have with the same knowledge everyone else has?

I often hear these hunches like “Travel is coming back, time to get back into airlines” or “China’s manipulating currency, I wouldn’t invest in those stocks”. Every time you make a change to your portfolio based on some instinct, you’re much more likely to hurt yourself than help yourself.

At the end of the day, any sort of change you make to your portfolio isn’t investing, it’s speculating. Investing is buying the whole market in an index fund and owning it for a long time.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram

September Sale!

September Sale!