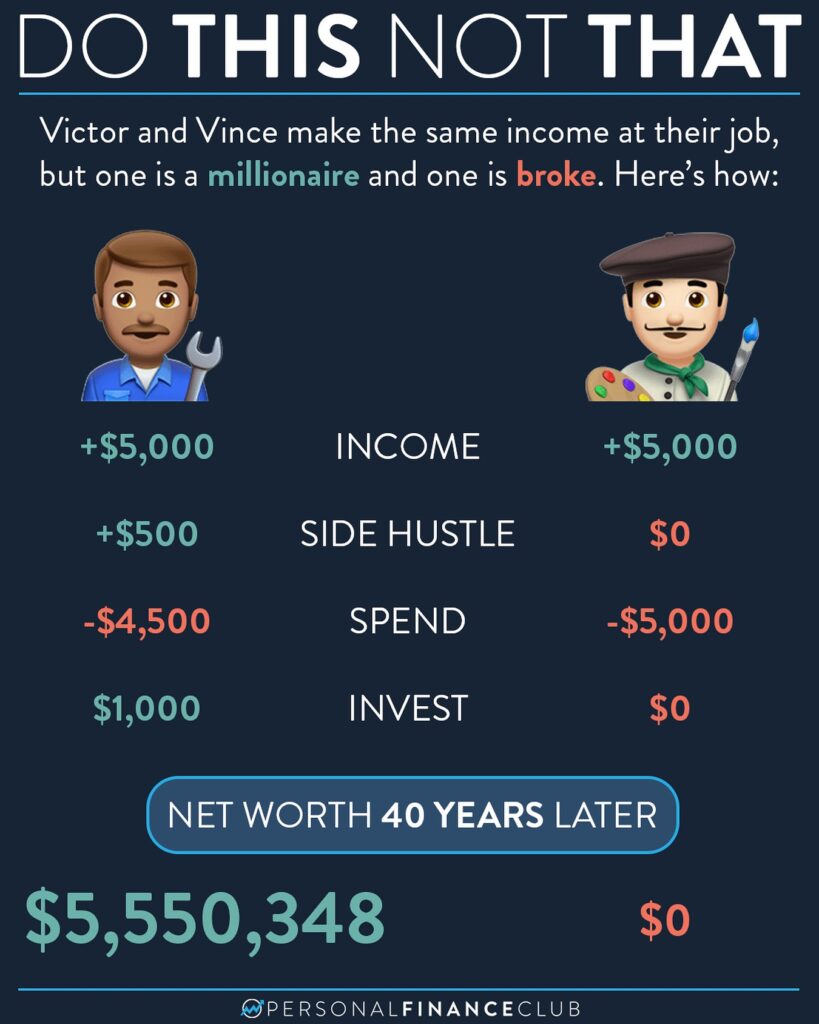

This post shows some basic math. If you invest $1,000/month for 40 years and get a 10% rate of return, you’ll end up with about $5.5 million. But I know this will be very uncomfortable for some people to see. It feels bad to see the math, but not be doing it yourself. Excuses start to pop up to rationalize. Let’s go through them:

• “No way you can live on $4,500/month”. The median household income in the US is about $80K/year. After taxes, that’s about $5K/month take home. HALF of households make less than this. Lots make $4,500 work. And if that number doesn’t make sense for you, that’s ok. This is just an example. Use numbers that make sense for you. But no matter what your numbers, if you spend everything, you’re left with zero.

• “$5M won’t be anything after inflation”. This is partially true, but if we’re talking inflation we should also be INCREASING the contribution amount for inflation every month resulting in an even higher end net worth. And to be fair, Vince’s number is also impacted by inflation. If you don’t like $5.5M, you definitely won’t like $0.

• “This is impossible”. I made this example because it represents VERY SLIGHT changes in lifestyle. Maybe Victor picks up ONE overtime shift per month, or does consulting for a few hours, or rents out a room in his house to make the $500 extra. And to reduce expenses by $500, it could be a couple extra nights cooking instead of door dashing, or a slightly more used car, or slightly cheaper rent. It takes some effort, but there’s money to be saved.

• “Victor isn’t even enjoying life”. HEY, YOU DON’T KNOW HIM. He’s actually an avid chess player with a village of adoring friends and family. He bird watches on the weekend, and volunteers for a children’s literacy organization. He’s an extremely cool dude. If you think the difference between enjoying/not enjoying life is spending another $500/month, you’re gonna be very disappointed when you start spending your entire next raise.

Behind all the COMPLEXITIES of investing and personal finance, it really comes down to the two rules at the core. Spend less than you make. Invest the difference.

-Jeremy

September Sale!

September Sale!