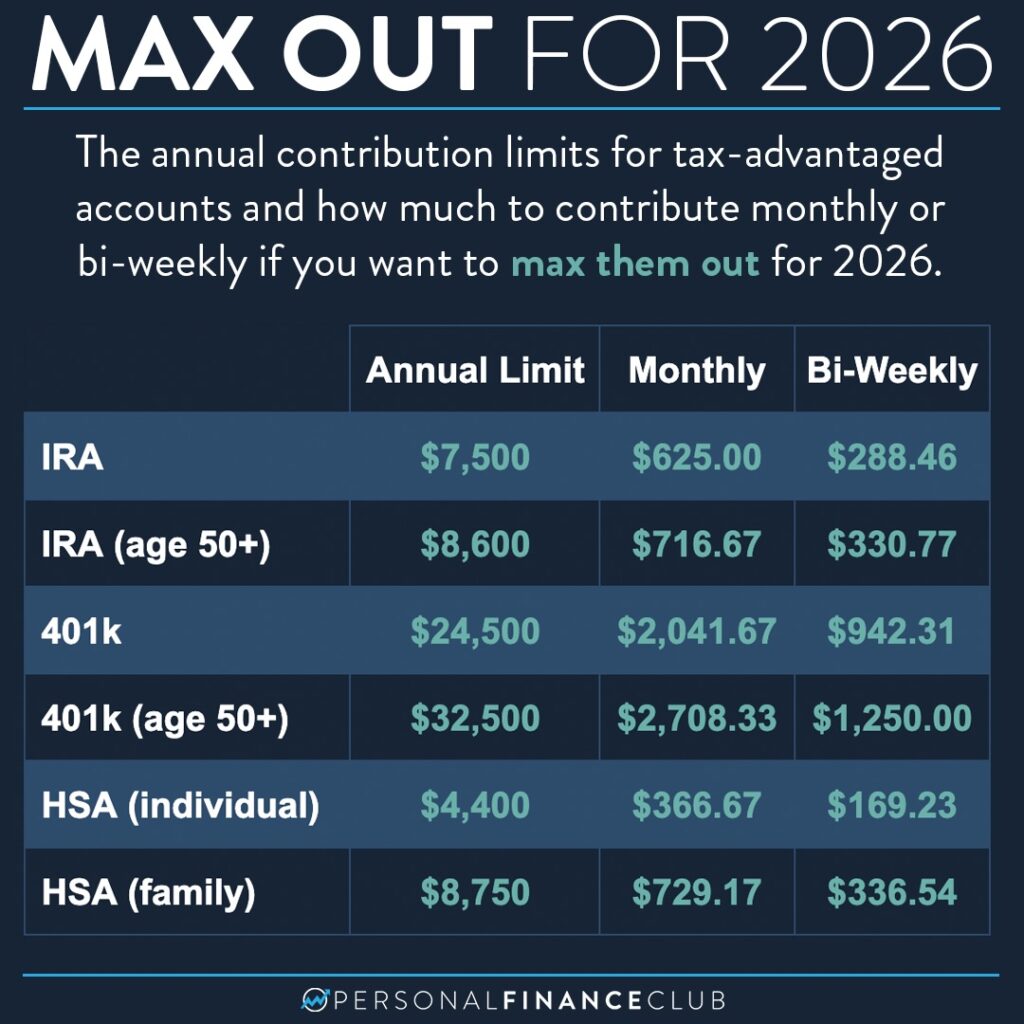

GREAT NEWS EVERYONE. The annual Roth IRA limit divides equally into 12 months again. Goodbye $541.66. Goodbye $583.33. HELLO $625.00!

I know there is SO MUCH complexity in the finance world. Every day I’m looking into so called “advanced” topics like selling covered calls, velocity banking, tax-loss harvesting, direct indexing, sequence of returns risk, yada yada yada. That stuff is mostly nonsense. Do you know what’s not nonsense and is actually going to make you more rich? PUTTING MORE MONEY IN. That’s the important thing. Everything else is window dressing.

So, now that it’s January, here are the numbers to hit monthly or bi-weekly if you want to max out your tax advantaged accounts. I personally just went to my 401k to change my bi-weekly 401k contribution to $942. Fun fact: SINCE I have a lot of money in a taxable brokerage account, I live primarily off of that, while funneling most of my income into my 401k. That helps a little with taxes, but it’s not as important as PUTTING MORE MONEY IN. (See the theme?)

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!