I finally got around to doing all the bookkeeping around my total remodel cost. Yep, the final bill was over $100,000. That doesn’t even count another nearly $10,000 in inspections, moving, new furniture, new blinds, etc. I’ll post a more detailed breakdown of the costs soon.

But here’s the thing. If I sell this place in 10 years, it’s just gonna be a condo with a 10 year old remodel. If I sell it in 30 years, it’s gonna be an old dump.

I hear some of you thinking, “but you’ll get your money back out!”. Yeah, maybe. I’ve flipped four houses in the last couple years and it’s game of thin margins. I could MAYBE just barely get my money out right now (I went nicer than a standard flip, and paid more to start with). So as an INVESTMENT, it’s not good. And GOING FORWARD will it continue to appreciate with the market and an aging remodel? Maybe.

When I talk about the costs of housing, I often hear how maintenance isn’t very expensive. But you NEED to do maintenance, including remodels, for your house to keep up with average appreciation (because other homes are being remodeled which work into that average). So when I break down my remodel cost over a 10 year period, it’s over $900 a MONTH. That alone, without any other “actual” maintenance is about 1.3% of the cost of the home every year. When thinking about your home ownership costs, make sure you’re honest with yourself about the real cost of maintenance in order for your home to realize the appreciation you’re hoping for.

Compared to my rental I was living in, I am sure I will be much less wealthy for having bought this place (I already am!) But I’m still rich. I can afford it (It represents about 22% of my net worth). And it’s a pretty baller place now. And life isn’t all about dying with the most money in your bank account. So I went for it.

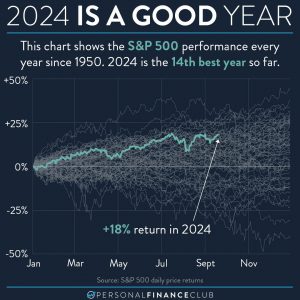

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

via Instagram

September Sale!

September Sale!