Becoming a millionaire really is this simple. Live on less than you make. Invest the difference. Let compound growth do the work over time. Why doesn’t everyone do this? Well as Warren Buffet says, “because nobody wants to get rich slowly”.

So where does the 10% come from? That’s about what the US stock market has averaged over the last 100 years. Over the last 40 years, it’s over 11%. This doesn’t take into account inflation, but it also assumes no raises over the 40 years as most people are likely to increase their income and investments over time.

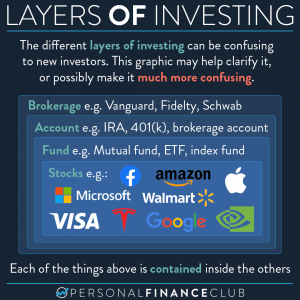

So how do you get that 10%? Invest in an index fund early and often. Leave it alone and let it grow for decades.

Why is it tax free? Because any money invested inside of a Roth IRA is tax free!

Spend a little less during your working years and you get to be wealthy at retirement. (Spend a lot less, and you can retire earlier!)

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

via Instagram

September Sale!

September Sale!