Key Takeaways

- Keeping your financial advisor is better than not investing at all

- The fees of a financial advisor can add up dramatically over time

- Begin by investing on your own for a few months

- Send your advisor a short note letting them know you’ll be self managing

- Initiate a transfer from your new brokerage

- Review and set up your investments once the transfer is complete

When To Keep Your Financial Advisor

Financial advisors aren’t bad people. I feel a kinship with with them in that we’re working toward a shared goal: Helping people with money. Any individual would absolutely be better off using a financial advisor for investing compared to not investing at all. If that’s the realistic choice in your life, stick with the advisor. Additionally, certain situations like those with very high net worths or dealing with complexities around estate planning or tax strategies in retirement may be well served by using a financial advisor.

That said, for most young investors in the wealth building phase of their career using a financial advisor is absolutely not worth it. There’s nothing tricky to be done with investing when you’re building wealth. Plow money into a low fee index fund. Set up automated contributions. Leave it alone for years.

The Costs of A Financial Advisor

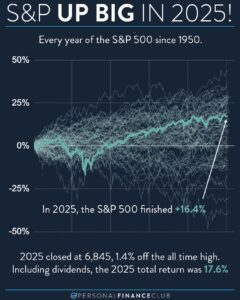

If an investor charges just a 1% annual advisory fee and recommends actively managed mutual funds that charge (an additional) 1% expense ratio, that 2% net fee will erode about HALF of your portfolio over a 40 year investing career. And for those investing less than $250K or so, you won’t get such a sweet deal. The advisors who will work with lower net worth individuals will charge front loads, statement fees, and more making the net impact that much worse. During your wealth building years, minimizing fees is one of the few things you can actively do to maximize your return.

If you do need an advisor, it’s usually best to work with a flat-fee financial advisor. That is an advisor who charges by hour or project, and DOESN’T charge an annual AUM fee, or sells products which pay commissions.

Step 1: Invest For Yourself For 6 months

The first step to firing your financial advisor is to not rush into it. Before you pull the plug, take a few months to make sure you’re prepared to manage your investments going forward. Start with a small amount of money. Open an account with Vanguard, Fidelity, or Schwab. Put your money in, buy your index funds (which funds?), and watch them for a few months.

Once you have at least a few months of managing your own investments under you belt, you’ll be better informed on what your investment advisor was actually doing and if the fees are worth it. If you conclude they’re not worth it, or you don’t like what they were doing, proceed to step 2!

Step 2: Send Your Advisor a Nice Note

Keep in mind that your investment advisor has absolutely no right to keep your money. It’s your accounts, and your money, and these things are tightly regulated. There may be some sort of modest account closure fees (Not more than $200 or so), but those are generally never a reason to stay with an investment manager you’d otherwise leave.

Some quick tips on sending a firing email: Keep it short and don’t air any grievances. Choosing this time to complain will just give them an opportunity to respond and push back, making it more drawn out and ugly. Genuinely thank them for their service, be polite, wish them the best of luck, and let them know they should expect an incoming transfer request.

Step 3: Initiate the Transfer From Your New Brokerage

The major brokerages (Vanguard, Fidelity, and Schwab) are good at this. You go to their site, click the transfer button, and follow the steps that you’d like to initiate a transfer from your old financial advisor. This process isn’t especially quick or romantic but it will work. If you have any trouble, call your your new brokerage. They generally have great support and interest in making this process work for you. It will generally take at least a few days up to a couple weeks for everything to go through.

Timing on this step doesn’t really matter. Just like you can’t time the market, there isn’t a good or bad time to do this. Do it when you’re ready to manage your own investments, not when you think the market is up or down.

Step 4: Set up your new investments

When the transfer is complete, it’s very important to login to your new brokerage account and make sure your investments are set up correctly in the index funds you want. Depending on how the transfer happened, your investments may have been liquidated, in which case you’ll have cash sitting in your account, or they may be in the same investments held at your old brokerage. Either way, it’s important to set them up as you wish. Note that there may be a tax implication to selling investments at a gain (or at a loss) so if you have huge unrealized gains or losses on these investments, it may be worth talking to a tax professional about the implications.

If you’re new to DIY investing, check out the start here video series.

Step 5: Consider a flat-fee advisor when you need help

It’s usually best to manage your own investments without the need for an “asset manager”, but if you want a set of expert eyes or need help with financial planning, consider using a flat-fee financial advisor, like those listed on Nectarine. Flat-fee advisors don’t sell any products, earn any commissions, or charge an annual AUM fee just for holding your investments.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!