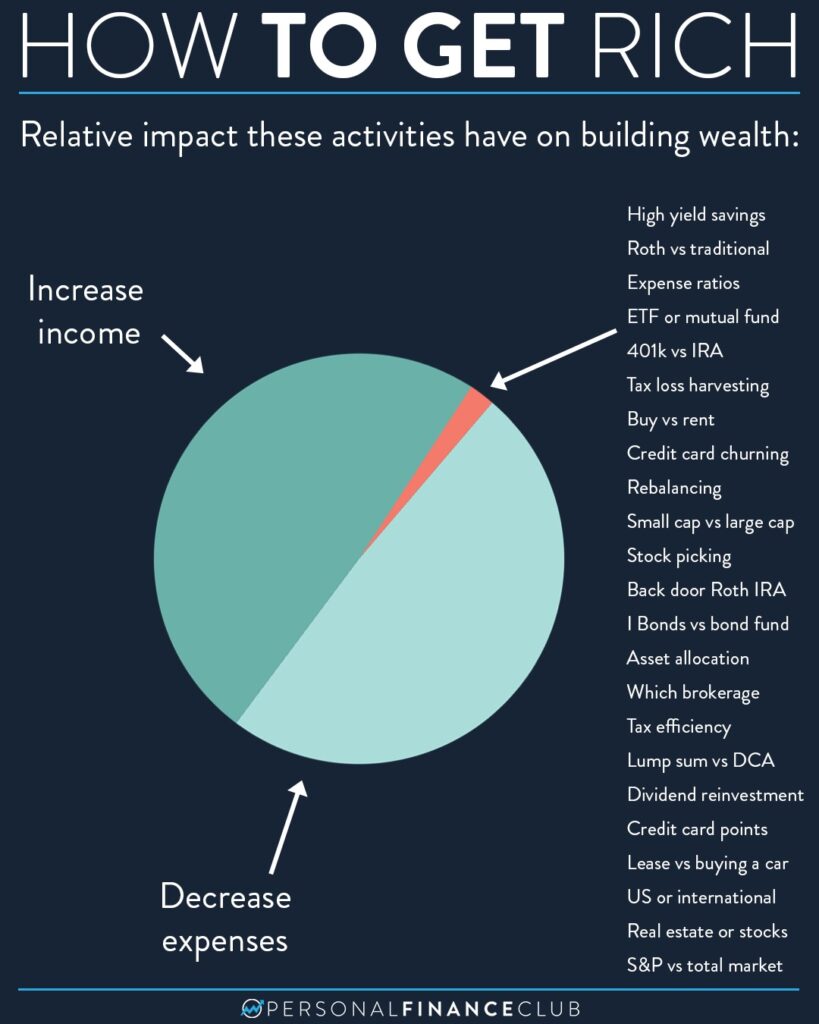

I’ll admit, I really like talking about that long list on the right. In fact, most of my posts are about them. They’re academically interesting. They can feel like “wealth building hacks”. Who doesn’t want to take advantage of “tax loss harvesting” or a “back door Roth IRA”. So fun! But as with all hacks, they can serve as a distraction from the primary issues. To build wealth, you have to earn more and spend less. The difference between those two numbers is the entire ballgame. A really crappy investor putting away $1,000/month will trounce an optimal investor saving only $100/month.

That’s why I end all my posts with the two rules. Even though I love to talk about the fine tuning, we can’t lose sight of what makes the biggest impact. We should never let fear of failure stop us from getting to work on the big things. “I don’t understand dividend reinvestment, so I’m gonna spend every dollar I earn” is a recipe for staying broke. “I don’t understand investing, so I’m gonna work on saving money while I learn more” is how broke people turn into millionaires.

So focus on the big stuff. Keep learning along the way. Become a millionaire. Retire early. That’s the real wealth building hack.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!