See what Amanda did? This is how most rich people get rich. They spend less than they make and they invest the difference.

Ashley and Amanda’s take home pay of $4,000 per month is about the median for US households. And Amanda’s 7% investment return? Also unremarkable.

The US stock market has returned 11.4% on average over the last 40 years. When you adjust that for inflation, it’s 8.3%. This example assumes a 7% rate of return, which is well below the inflation adjusted historical average. So that $2.1M is in today’s dollars.

So… what’s the secret to getting rich?

There is no secret. There’s no magic. Optimal investing is simple. Buy and hold low cost index funds. Invest early and often. Ignore the noise. Don’t try to get rich quick. Stay the course. That’s how you get rich.

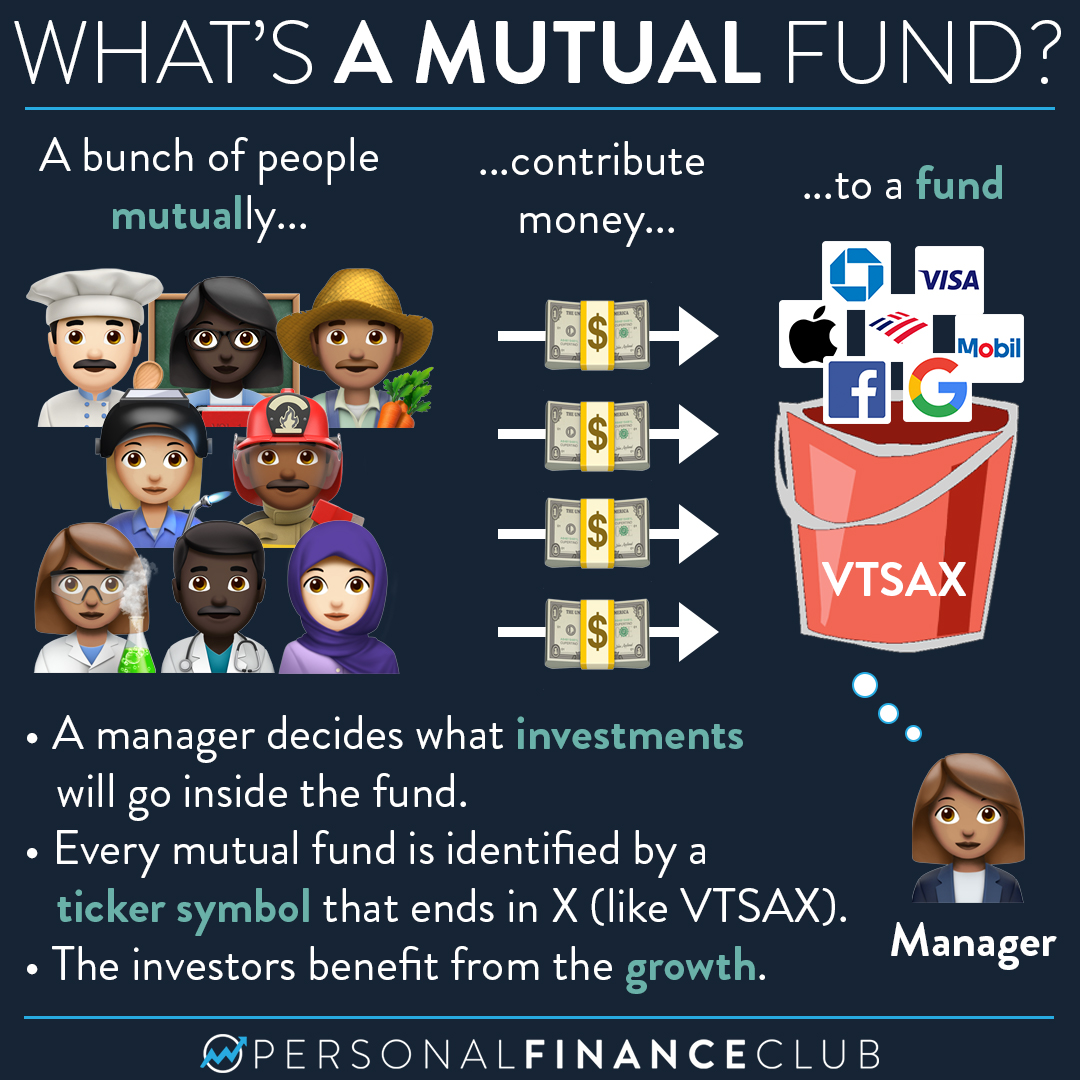

First, you should know that index funds are a type of “mutual fund”. A mutual fund is a bunch of money (a fund) owned by a bunch of people (mutual).

Back in the day, all mutual funds were “actively managed”. That means a smart manager was paid to take all that money, and buy a bunch of stocks with it at their discretion. If you wanted to invest, you would put some money into the mutual fund and then you would get a piece of all the stocks the smart person decided to buy. It was a nice way to diversify your portfolio without having to do all the research and trading yourself.

But here’s the problem with actively managed mutual funds. The smart managers charge a high fee for their services. And they’re competing against a bunch of other smart managers who also charge high fees. So all the individual investors are paying a lot of money to trade stocks back and forth and end up with less money than those stocks actually provide.

Now, enter the index fund! Instead of paying a smart manager a high fee to trade stocks back and forth, an index fund is a type of mutual fund that just buys EVERY stock in a list.

For example, an S&P 500 index fund owns the 500 biggest stocks in the US. It turns out, since the market is “efficient”, all the stocks are priced about right, so buying all of them is a great way to fully diversify and guarantee your fair share of the market growth.

Index fund fees (or expense ratios) are typically 10x-50x lower than actively managed mutual funds, and their performance is almost always better.

There aren’t really “good” or “bad” index funds. They all do the same thing and that’s the point. They follow the index they’re assigned to.

The 12 index funds listed here are kind of a mixed bag. Some are mutual funds, some are ETFs. Some follow 500 of the biggest stocks, one follows 1000, and the rest follow the total stock market (~4,000 stocks). They’re offered by different companies like Vanguard, Fidelity, Schwab, etc. And their expense ratios range from 0.015% to 0.14%.

With all those differences, they all essentially do the same thing. Own a bunch of US stock. And after over eight years of tracking a $10,000 investment, the difference between the highest performing index fund and the lowest performing one turned out to be $27,972 versus $27,168. Not a big deal.

SO, don’t get caught up in the weeds. But to FULLY diversify, with even more simplicity, consider a target date index fund.

Target date funds are “funds of funds”. Each is a single fund that holds several index funds inside of it. They’re usually composed of:

Target date index funds are diverse, low cost, and eliminate the guesswork out of investing. With a single fund, you dump everything in it, forget about it and you’re rich.

And voila! You’ve figured out which target date index fund to buy!

Hi! I’m Jeremy. I retired at 36 and currently have a net worth of over $4 million.

The world of money and investing is confusing. There’s a multi-trillion dollar financial services industry ready to take advantage of you. But financial literacy can help you navigate this world of money.

Personal Finance Club is here to give simple, unbiased information on how to win with money and become a multi-millionaire!