Finding good professional help can always be tricky, but here’s one really important piece of advice: Don’t take financial advice from someone who also sells financial products.

Unfortunately the financial services world is MOSTLY FILLED with these hybrid professionals. They call themselves financial advisors who help with your financial problems AND they conveniently sell you the products to fix those problems. No matter how much they may throw around the word “fiduciary”, that business model represents a massive conflict of interest. Whether or not they believe it themself, their actions will absolutely be skewed towards pushing you into the products they sell. After all, that’s how they put food on the table.

I’ve talked to countless expert financial advisors who DON’T sell insurance products (but do advise on insurance needs). When I ask if they would recommend permanent life insurance to build wealth, they all say no. Yet when you talk to financial advisors who DO sell permanent life insurance, virtually all of them are sure that their clients should be buying it. That’s the conflict of interest in action.

So when you’re seeking out financial advice, keep this in mind. If you need a financial advisor, great. When you need insurance, great. Just get those services from dedicated professionals. If your financial advisor suggest you buy permanent life insurance, it’s time to run away. They’re not acting as a financial advisor, they’re acting as an insurance salesman.

p.s. Most of you know I co-founded @hello_nectarine with Vivi and Shane to address this problem! Nectarine advisors don’t sell any products, manage your money, or earn any commissions. They charge a clearly advertised, flat hourly fee and that’s it. But they can absolutely share a screen with you and help you directly with your investments, insurance, and everything else in your financial life.

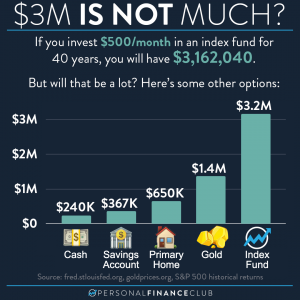

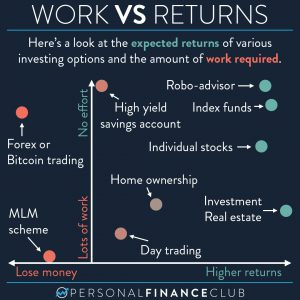

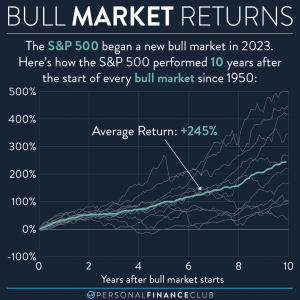

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!