All right, here’s the math on this one. Nicole is living off her day time job salary and putting 100% of her side hustle towards investing. She makes $100 per night, twice a week, 52 weeks per year. That’s $200 per week, $800 per month or $10,400 per year invested in index funds from the age of 20 to 30. $104,000 total invested.

She started young so that money has between 35 and 45 years to grow before she’s 65. At a 10% rate of return, her portfolio grows to over $5.6M! This shows the power of focus and investing early.

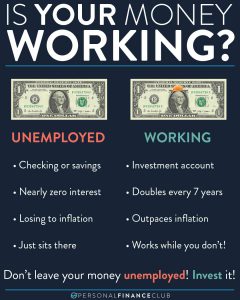

If you have seen 4% savings account ads and are wondering where to get 10%, the answer is in the stock market. It’s not as consistent as a savings account, but over the last 40 years, the S&P 500 which tracks the US Stock Market has gained about 11.4% per year on average. It can be volatile over short periods, but there has never been a 20 year period where the market has been down.

And yeah, this doesn’t take into account the impact inflation will have on her buying power, but Nicole will still likely easily be a millionaire by today’s terms which isn’t too shabby.

Buying into the US or world stock markets is easy. You just buy a low fee index fund through an online brokerage like Fidelity, Vanguard, or Schwab.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

September Sale!

September Sale!