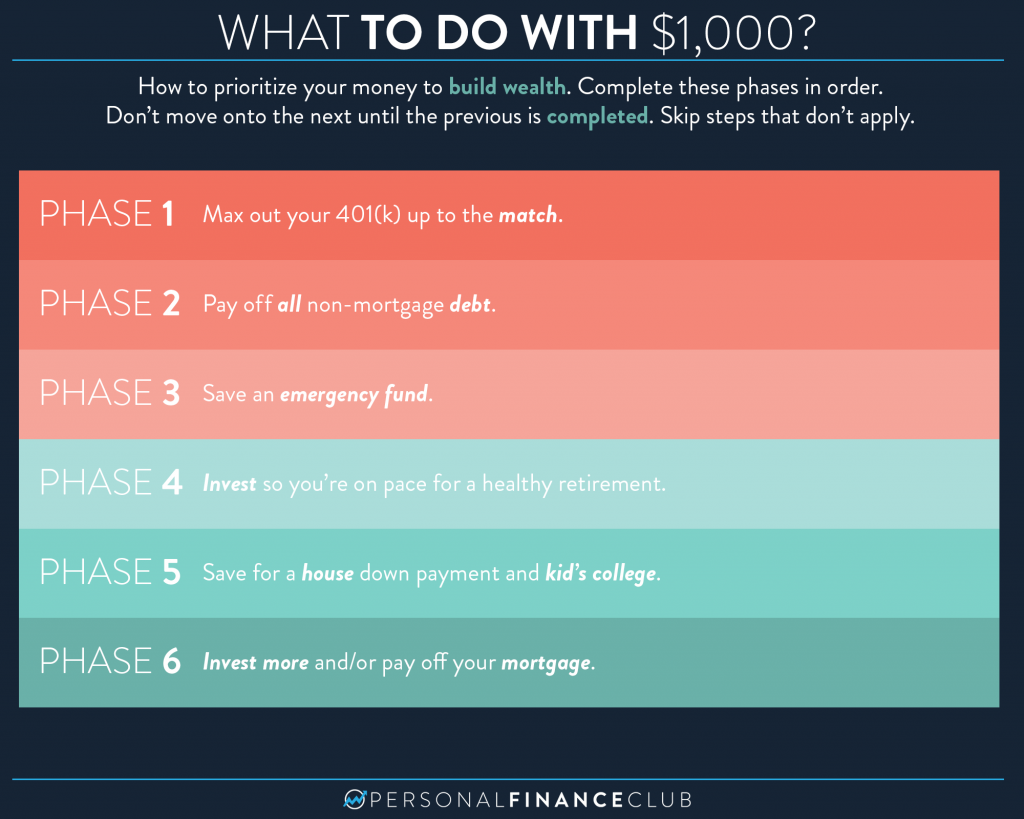

In order to build wealth, it’s important to have a plan and focus. These phases of investing help prioritize how you put your money to work in order to maximize your future wealth. Do these in order. Don’t move onto the next until the current phase is completed. (But once you progress past a phase, you keep going at it. i.e. you’re always maxing out your 401(k) match even if you’re also saving for a house down payment)

Phase 1: Max out your 401(k) up to the match

What to do: If your employer offers a 401(k) or similar retirement plan and offers a match (where they put in money as long as you do), sign up for that plan and contribute enough money to it to maximize your employer’s match.

Why: An employer match is free money that you’re flushing down the drain if you don’t sign up. Most will match 100% of the amount you put in, up to a set amount of your salary (e.g. 3% or 5%). So if you have a 100% employer match up to 5% of your salary and you make $50,000 per year, that means if you contribute 5% of your salary ($2,500) your employer will put in an additional $2,500 into your account. That is an instant 100% return on your money. Even if you have high interest debt, this 100% instant return is a better deal for you. (In the extreme case, you could drain your 401(k) and the match, pay the 10% early withdrawal penalty and taxes and still come out ahead, but don’t do that).

Phase 2: Pay off all non-mortgage debt

What to do: With every available dollar beyond your living expenses, throw it at your debt until your non-mortgage debt is 100% gone. Seriously. I prefer the debt snowball method.

Why: I know new investors are itching to put their money to work for them and don’t want to waste time paying off debt before they get started. But trying to invest while you’re in debt is like running up the down escalator. The debt is crushing your income, adding stress to your life, adding risk to your financial life and blurring the focus of your income. Remember that your net worth includes all your debt counted against you. So when you pay off your debt, you’re increasing your net worth. And you’re getting a guaranteed return of not paying that interest anymore. Even if you have low or no-interest debt getting those payments out of your life will allow you to focus and move faster through the rest of the steps.

Phase 3: Save an emergency fund

What to do: Save a healthy emergency fund (generally 3-6 months of your living expenses) in a savings account, separate from your checking account where you pay your bills. Do not invest this money. Forget about it and move to the next phase. When you have an actual emergency you’ll know you need it.

Why: Your emergency fund does the important job of acting as “not poor insurance”. When you have an emergency, you don’t want to fall back to the gauntlet of being poor (overdraft fees, credit card interest, payday loans, etc.) By leaving your emergency fund in cash it’s helping to build your future wealth by not letting yourself fall back into the trap of being poor.

Phase 4: Invest so you’re on pace for a healthy retirement

What to do: Open up a retirement calculator, put in your numbers and figure out how much per month you need to invest so that when you’re 65 you’ll have a healthy nest egg. Invest that much money (and no more during this phase) in index funds, prioritizing tax advantaged accounts.

Why: Now that you’re out of debt, and have an emergency fund so you’re not broke, it’s time to make sure you stay not broke. Now is the time to invest early and often to make sure you have a healthy and dignified retirement, and aren’t destitute, working until you die or a burden to your family. The tax-advantaged accounts (IRA, 401k, 403b, TSP, SEP, etc) are “use it or lose it”. If you don’t contribute the money during tax year, you don’t get the tax break.

Phase 5: Save for a house down payment and kid’s college

What to do: Your primary home isn’t a great investment, but if you want to be a homeowner, this is the time to save for a 20%+ down payment on a house. Save it in a regular savings account. Don’t invest it. If you have kids, this is the phase where you save for their college funds, likely in a tax advantaged account like a 529.

Why: I know, I know. You don’t WANNA wait this long to buy a house. But here’s the thing. If TODAY you can’t even put away enough monthly for a healthy retirement, how could you ever catch up YEARS from now when you’ll need to save EVEN MORE per month (without the advantage of time on your side) and when you’ll have a big mortgage to keep up with. If you buy a house too soon, you end up house poor, where all your money goes into this single asset that actually loses money after expenses. I don’t suggest you should be a renter your whole life, but if you rent or buy modestly and invest earlier you will be much more wealth.

Regarding the kid’s college, the “airplane mask” theory applies here. Make sure your own finances are taken care of before you try to help your kids (other than like feeding them and stuff). I know you want to get them started on the right foot. But setting a good example for them and not being a burden to them in your old age will be a better gift than living broke and trying to throw some cash at them for college.

Phase 6: Invest more and/or pay off your mortgage

What to do: Keep investing in the priority order of accounts and or/pay off your mortgage ahead of schedule.

Why: This is the fun part! You’re finances are in good order, now you get to build massive wealth! If you’re on the FI/RE track, go nuts on those investment accounts. If you love the idea of not having a mortgage, pay it off fast. Both are good options. More focus on investing is a little more “aggressive”, i.e. you’re using the leverage of your house to amplify your investment accounts. Focusing on the mortgage is a little more conservative… your home can’t be foreclosed if there’s no mortgage. And if you get mortgage free, then you can have your full income to invest even harder!

September Sale!

September Sale!