When you zoom way out, no one month or one year matters. Long term investors will barely remember that the stock market was down in 2022. They will be too busy counting their wealth to care what the market did on any given year.

It’s easy to feel anxious when the stocks are down and feel great when the market is up. The constant news cycle will remind you of how bad things are whenever the market is down. But you have to tune all of that noise out and remind yourself that you’re a long term investor.

Investing can help you create massive wealth. But only if you don’t care what happens in the short term. If you can’t handle a down month or a down year, you will never experience the beauty of compound growth that only happens when you remain invested for decades. Wealth is built by buying and holding good investments.

Invest a portion of every paycheck in low cost index funds. Keep doing this during up years and down years. That’s the only way to guarantee yourself a fair share of the market growth over time.

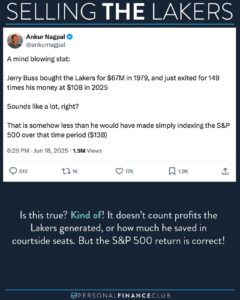

The post is using the S&P 500, including dividends. Of course, 2023 is not over yet so the returns are year to date as of yesterday.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane

September Sale!

September Sale!