It’s so easy to feel FOMO when you hear everyone around you talking about how they are getting rich from an investment they just made. You want that to happen to you too! But, if it’s too good to be true, it usually means that there is a lot of risk and everything could come crashing down at any moment. And this is exactly what happened.

In 2021, it was hard to have a conversation about personal finance without someone bringing up crypto or meme stocks (AMC, GameStop, and so on). There were countless social media accounts just dedicated to promoting these strategies to unsuspecting investors. It ended the way it always does. The people that get caught up in the hype lost a big chunk of their money.

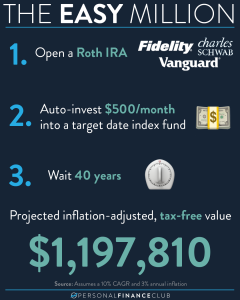

There are no shortcuts for building wealth. Trying to take a shortcut to earn a really high return is usually the exact thing that keeps you from building wealth. You have to keep focusing on increasing your income and spending less than you make. Take that savings and invest it in low cost index funds. Do this for decades and you will be rich.

We are using Google search trend data to represent when each of these “investments” were the most hyped. For most of these, the peak in Google search trend data is exactly when these over-hyped investments hit their peak and began their free fall. The S&P 500 return number is from January 2021, which is when most of the items in the graph peaked.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane

September Sale!

September Sale!