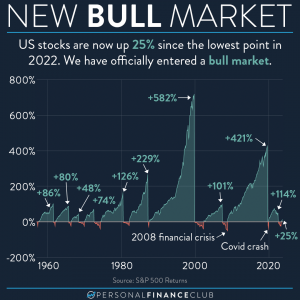

I haven’t been hearing much about the stock market lately. It makes BIG NEWS when it goes down a little bit. Everyone runs around like their hair is on fire screaming about how the gravy train is over all of commerce is going to evaporate into thin air leaving everyone destitute. But when the market is going UP, you barely hear about it. Why? Because the market usually goes up. Have you heard the saying “dog bites man isn’t news, man bites dog is news”. That’s the same with the stock market. The crash is news because it’s unusual. The normal state of things is the market breaking all time record highs.

But as humans, we’re predisposed to feel more pain from loss than we do pleasure from gains. The news cycle amplifies that making it seem like crashes are common and the market is a yo-yo. But that’s not how it works. The stock market is four steps forward, one step back. We hear a lot about the step back, but we’re currently in one of those four steps forward bull markets.

What do you do about this? Buy and hold. Invest early, invest often. Let the market do the work.

Often in my comments I hear someone saying something like “the big crash is coming, you’ll see”. My thought is usually, “oh yeah? Bet against the market. Good luck”. There’s lots of ways to bet against the market (shorting stocks, inverse ETF, buying puts, etc). But when I think of someone trying to make money doing that, I think of these charts. The market is an massive unrelenting steam engine with unfathomable momentum going UP. Betting that it’s going down is like jumping in front of that steam engine and saying “bet you can’t get me!” It can.

Anyway. Don’t jump in front of trains. Don’t bet against the market. Do buy and hold index funds. It’s a good way to build wealth.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!