We get a lot of questions about what can be done if you are behind on your investing journey. Unfortunately, there is no magic answer to this. In order to catch-up, you have to find ways to invest more money.

How much do you need to retire? The goal is for your investments to hit a value of roughly 25X your annual spending. Once you’re there, you can rely on the “safe withdrawal rate” to provide enough income, even adjusting for inflation, to cover your cost of living in retirement.

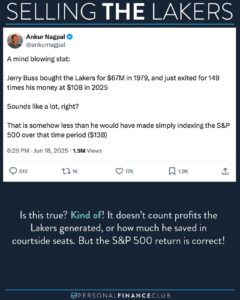

In our example, we are assuming a 10% annual rate of return because that is the average yearly return of the stock market over the past 100 years. It’s never a straight line up, but over decades it averages to that. And we adjusted it for inflation, assuming 3% annually. Inflation over the last couple years has been higher than that, but over the past 100 years it has averaged 3%.

Want to see how much you need to invest per month in order to hit YOUR retirement goal? Try the ‘Investment growth retirement calculator’. You can enter your information like your age, starting investment, retirement age, and cost of living.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane

September Sale!

September Sale!