If you look back at the 37 times the market has dropped 10% or more since 1950, the average length of the “crash” from record high to bottom of the dip is about six months. The S&P 500 record high was set on January 4th, 2022, or about 4.5 months ago. Does that mean we’re near the bottom of the market? Unfortunately, nobody knows. The market was up 2.4% on Friday, so maybe Thursday was the bottom. Or maybe it will fall more next week. But historically, six months is the average. And 100% of previous crashes have resulted in the market breaking new record highs.

Now, I know what you’re gonna say. BUT THIS TIME IS DIFFERENT. Supply chain issues! Housing prices! Increasing rates! Looming recession! Inflation! Concrete takes a long time to deliver! Surely all these factors mean that the market is doomed this time? Well, that’s what they say every time. Let’s see what they were saying in some other years:

2020: Once in century pandemic! Global supply chains shutting down! Small businesses are doomed! Record unemployment! Feds are printing money like it’s coming out of their weiner!

2009: Subprime mortgage crisis! Housing bubble burst! Record foreclosures! The great recession! Banks are failing! The literal fabric of our financial system is disintegrating!

2000: Y2K! 9/11! Venture capital disappearing! Increasing rates! Looming recession! Pets.com! Nasdaq down 78%! Dotcom crash!

It’s easy to focus on the negative, but the market is where it is because of a balance of pessimistic and optimistic forces. Over the short term it’s impossible to predict. But over the long term it MUST go up, because it’s measuring the total economic output of all companies contained within. Those companies will continue to do business and profit. After the short term volatility works itself out, the market will continue to produce positive returns for those who buy and hold.

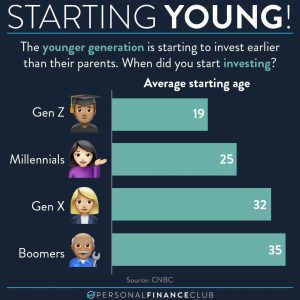

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram

September Sale!

September Sale!