The vampire’s comment here is the most consistent comment I get on any post where I talk about building wealth. It goes something like this “IT’S GONNA TAKE SO LONG?! GREAT SO I CAN BE RICH WHEN I’M DEAD???”

To be fair, those commenters have a point. The benefits of investing shouldn’t be to die with the most money in the bank. That would be a total waste of the resource that money can be for your life. Money is meant to add value and enjoyment to your life. Never spending any of it and dying with the most is failing with money.

But the pendulum often swings too far the other way. Someone who doesn’t save or invest at all is not maximizing their life value. In fact, that’s a very stressful way to live. If you have no savings and investments, any tiny bump in the road can devastate your life. And when you’re living like that, you can FEEL it in your bones. Loss of a job, increase in taxes, medical emergency, transportation issue, relationship breakup, child emergency, etc. Any of these things could leave you broke or worse. And living day to day not knowing that you’ll be able to deal with what’s looming is terrifying.

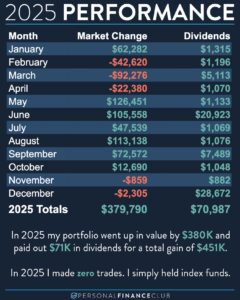

So while, I agree with “what’s the point of money if you’ll be dead” there are many IMMEDIATE benefits to saving and investing. You’ll FEEL better in your bones. And likely, when you finally see some traction, that progress will accelerate. And you will find yourself a millionaire much sooner than that original line graph predicted.

It’s easy to be cynical. It’s easy to sit back and poke holes in people’s success or efforts to improve themselves. It’s easy to look for the worst in any situation. But that’s not going to make YOU a better life. Be the optimist. Instead of looking for ways something might not work, look for ways to make it work. You’ll be happier and more successful if you do.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!