Your net worth is the number that most accurately depicts your financial situation. Improving it should be your primary financial goal. When a friend asks me for help with money, the first homework assignment I give them is to put together a net worth statement like the one shown on the second slide of this post. If you don’t know where you currently stand, it’s impossible to decide where to go! I also believe that “numbers that are watched improve”. Once you put your net worth on paper and start tracking it over time, it’s going to seep into your subconscious and behaviors that impact your net worth will change for the better. (Maybe you shouldn’t take on 20K of debt for those two wave runners?!)

My net worth increased by $712,000 this year. A bit of that was income from Personal Finance Club, but the vast majority of it was from me doing nothing. Just sitting on the same index funds I’ve owned for years. I collect and reinvest the dividends, the share prices goes up, my net worth goes up! When you hear about “compound growth” this is what they mean. It’s like a snowball that grows over time getting bigger and bigger. I was lucky that I started going hard early in my career building my first business. About 11 years after I started it, I realized the gains from that hard work. That fast forwarded me to the later stages of compound growth where my investments are growing at a rate way faster than I could get from actually working a job! How cool!

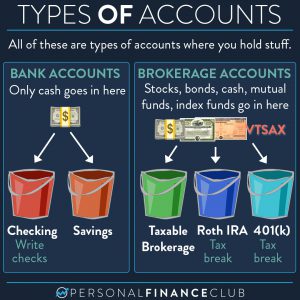

Almost all of my investments are in simple index funds, check out my course!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram

September Sale!

September Sale!