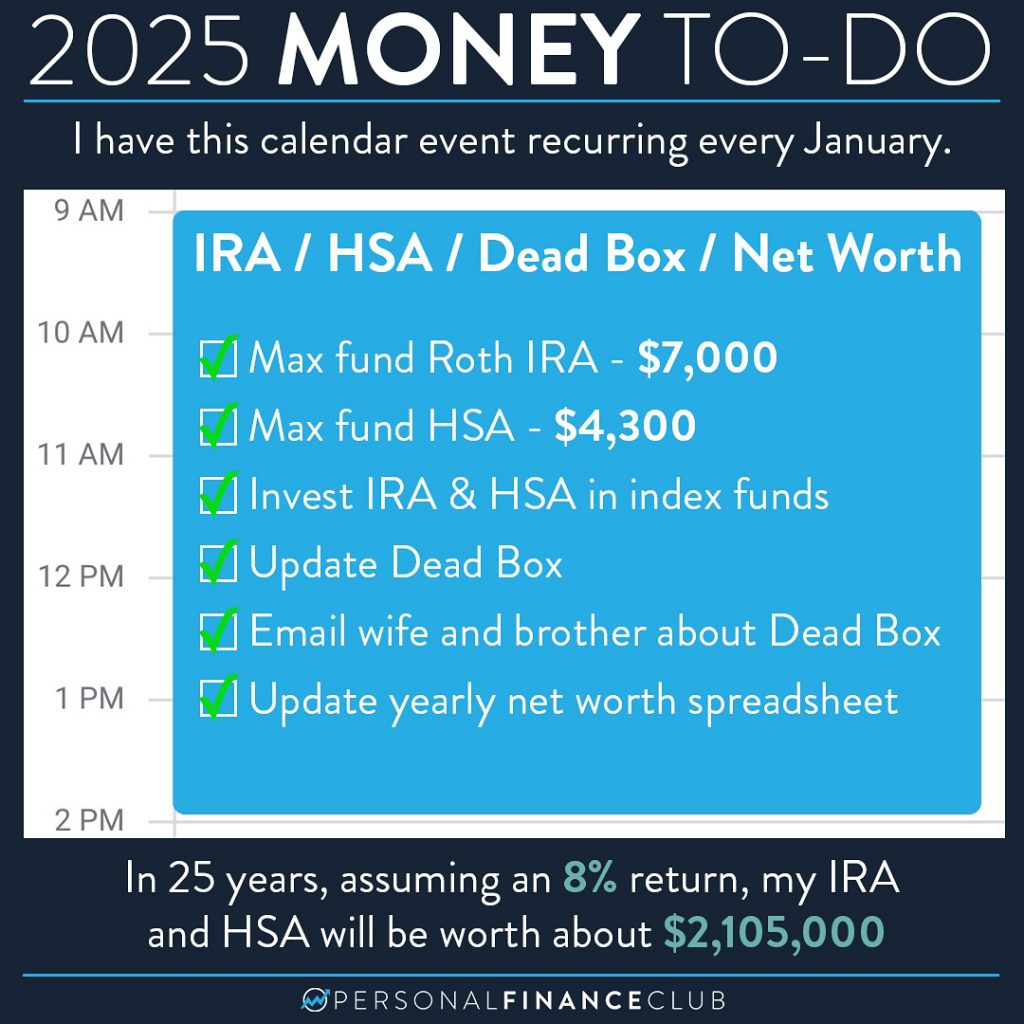

This is an annual recurring event on my actual calendar. These are the few financial things I make sure to take care of at the beginning of each year. To break them down:

• I’m almost always over the Roth IRA income limit, so I do a “backdoor” Roth IRA which consists of contributing to a Traditional IRA, then converting it to a Roth IRA. The max you can contribute to an IRA in 2026 is $7,500. (I have a video on Backdoor Roth IRAs in my course and an article on my website).

• HSAs have the best tax advantage of any account! Money goes in tax-free, investments grow tax-free, and money spent on qualified medical expenses is tax-free! I keep mine with Fidelity. I keep about $2K in cash to cover current medical expenses, the rest I invest in a target date index fund.

• Keep in mind putting money in an IRA or HSA alone doesn’t do anything. You have to take the second step and invest that money! I invest mine in index funds.

• I update my 401k contributions to hit the annual max. $942/paycheck for me.

• I go through my Dead Box and update it every January. It’s amazing what changes over a year!

• The dead box is no good if no one knows where to find it, so I email my wife and brother (will executors) to remind them it’s there and how to get to it.

• They say that “numbers that are tracked improve”. I’ve been tracking my net worth since I was 20 when it was about $5,000. It dropped to -$5,000 by age 22, but today it’s about $5.6 Million.

My Roth IRA is currently worth about $162K, my HSA has $38K, and my 401k has $216K. That amount plus the annual contributions invested at an 8% rate of return will be worth over $5.6M in 25 years!

If you want to learn more about this stuff stay tuned for a big announcement coming in the next couple of days about a big January event!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!