Last night, for the first time in my life, I put up CHRISTMAS LIGHTS on the outside of my house. It involved a ladder, going on the roof, and hammering things. My wife, who I have to assume has very little confidence in me, wanted to HIRE SOMEONE to do it. COME ON. This is like my suburban rite of passage.

We also got all the lights GIFTED to us from a neighbor who didn’t need them anymore. And I installed myself, so we did the whole thing for a cost of $0! Which is great because we’ve been BURNING MONEY lately on so many things. I’m going to post about that soon.

What’s the point of all this? I don’t know, but it’s officially holiday season!

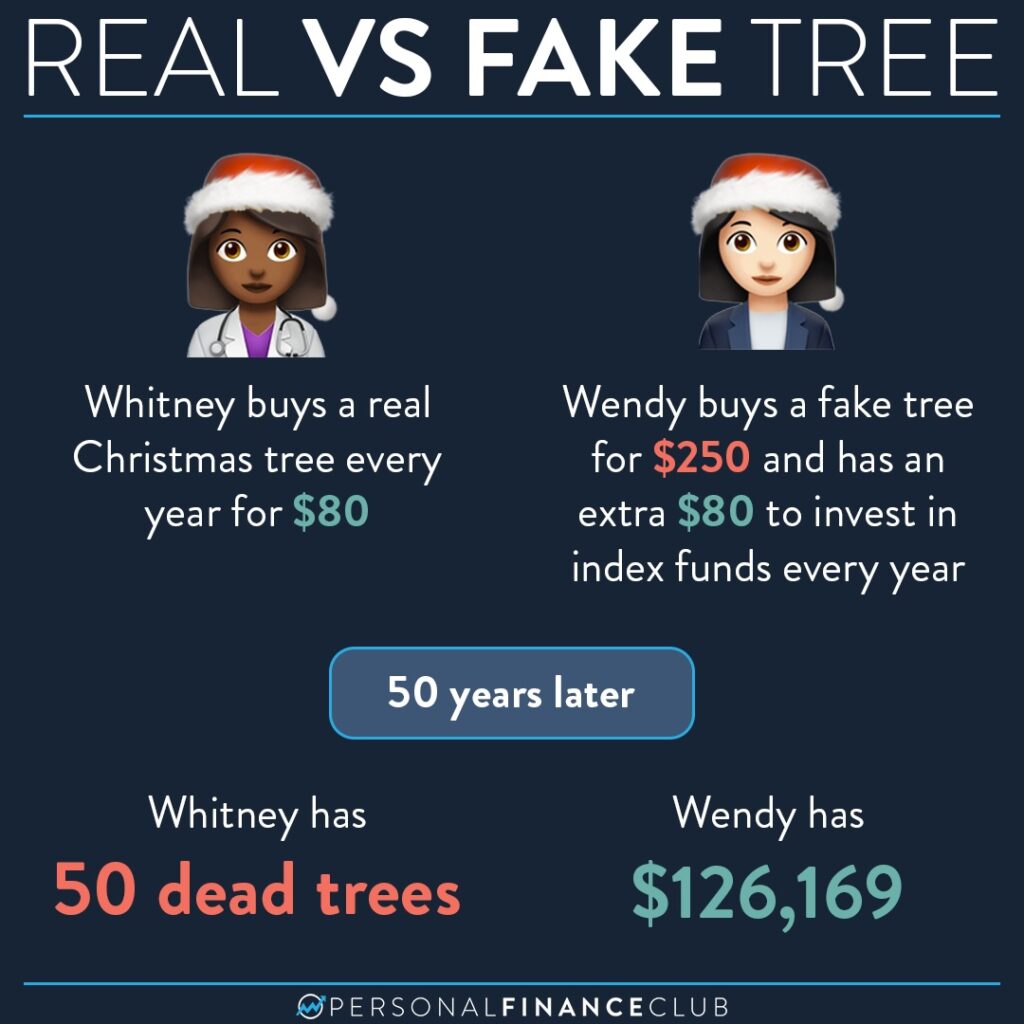

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!