One of the questions I get most about my investing strategy (invest early and often, take advantage of all tax advantaged accounts) is this: “What if I want to retire early and all my money is LOCKED AWAY in retirement accounts?!”

That is what I call “A good problem to have”. If your big worry is that you’re going to be SO RICH that you don’t need to work, EXCEPT for fearing a potential 10% early withdrawal penalty on money you take out before you’re 59.5 years old, I think you’re in pretty good shape.

That said, there are a LOT of ways to get at that money without the 10% penalty. Namely:

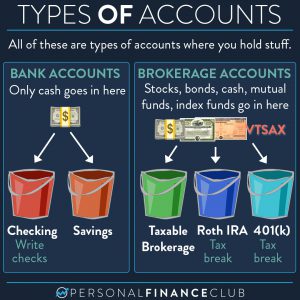

1. Brokerage Account: If you really do have enough wealth to retire early, it’s very likely all that money didn’t fit under the relatively low contribution limits for retirement accounts. The excess will be in a brokerage account where you can withdraw any time.

2. Investment Real Estate: Similarly, wealthy people generally end up owning properties. The income can support you at any time as it’s not in a retirement account.

3. Roth IRA principal: When you contribute to a Roth IRA, you can always take out what you put in at any time with no tax or penalty.

4. Roth Conversion Ladder: Any money contributed to Traditional accounts can be converted to Roth and then withdrawn after 5 years.

5. Rule 72(t): A law designed for early retirees. Basically you can set up scheduled withdrawals of a reasonable amount without any penalties.

6. Rule of 55: If you happen to quit between 55 and 59.5 you can access everything penalty free.

The above list gives MORE than enough ways to access plenty of that money when you need it (and you’ll want the rest to stay in tax advantaged accounts for years 59.5 to 100+ anyway!). So don’t fear your money being locked away. Be aggressive about maximizing every tax advantage the IRS will afford you.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

via Instagram

September Sale!

September Sale!