The quick answer

It doesn’t matter because you shouldn’t be holding cash in your Roth IRA anyway. So just pick SPAXX and go on with your life.

Longer explanation

If you’re using Fidelity, you might see a button like this:

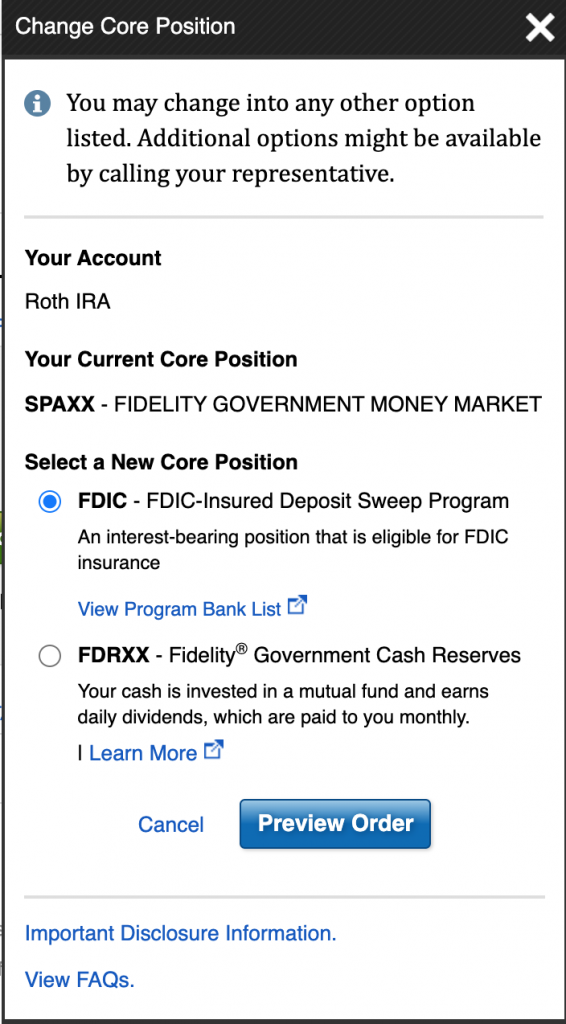

That looks tempting, so you click on it and see something like this:

So you have some options! Let’s break it down.

What is a “core position”?

When you open an investment account, like brokerage account or a Roth IRA the idea is that you put money into the account then use that money to buy investments (like mutual funds, ETFs, stocks, etc). But when there is money in there that hasn’t been used yet to buy an investment, it sits in the “core position”. Which is basically just cash sitting there, like a savings account. Since Fidelity is a full featured brokerage, they give you a few different ways to hold the cash. That’s what this choice is all about.

Why this doesn’t matter!

Since the point of an investment account is to invest, you generally shouldn’t have money just sitting around in cash. This is especially true for young people inside of a retirement account like a Roth IRA. If you have money sitting in your core position in your Roth IRA, you’re likely making a big mistake. You want to invest that money in something like a target date index fund. And since you’ll have no money in your core position, it doesn’t really matter what your core position is! That said, let’s break it down anyway.

Free investing mini course!

Get a 5 minute-ish video every day for 10 days!

You’ll learn why investing is necessary, which stocks to buy, and how to set up your account!

Don’t want to give us your email? Watch now by clicking here.

The options

- SPAXX: This is a money market fund. Basically a mutual fund (a fund that pools everyone’s money) that invests in cash and cash-like stuff… like CDs. It historically offers better interest rates than just sitting in a bank account while still being very liquid and safe (so it won’t go down in value and you can get your money out any time). CURRENTLY, SPAXX is paying 0.01%. That’s true for almost every cash account because rates are so low.

- FDIC: This is essentially like a traditional bank account. FDIC is a government insurance program that makes sure you get paid back if the bank goes out of business. So your cash is “insured”, but in exchange you likely get a lower interest rate. As of today, the FDIC account is also paying… you guessed: 0.01%.

- FDRXX: This is extraordinarily similar to SPAXX. In fact, the composition, description, overview, yield, and historical yield are virtually identical. In fact, the “strategy” section on each fund is word for word identical. Frankly, I think it’s silly for Fidelity to offer both as it serves to confuse people without giving an actual meaningful benefit. And yep, FDRXX is also paying 0.01%.

The bottom line

So, as you can see this really isn’t an exciting choice to make. Historically, and possibly in the future, I think SPAXX and FDRXX will have slightly higher interest than the FDIC account, so that’s what I would chose. But as I said above it really doesn’t matter. Just pick one and go on with your life.

September Sale!

September Sale!