These numbers seem a little wack-a-doodle the first time you see them. But it’s an example of house these differences compound to massive impact over time.

Erica was spending $50/night twice per week. That’s $5,200/year or $20,800 over the course of a four year college career. Even assuming a 0% cost on the loan, paying off the extra $20,800 over two years would be $867/month. Ouch!

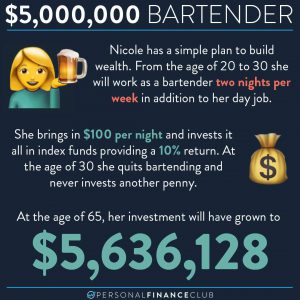

Emma on the other hand was moving her money UP instead of down. Her $100/week was $41,600 saved by the end of four years. But she wasn’t just saving, she was INVESTING, so with a 10% growth from an index fund, she ended up with $52,100. Not bad, but that pales in comparison to the rest of her career as that money continued to compound. Even if she never saves another penny, $52,100 at a 10% rate of return for 43 years (22 to 65) is over $3.1 MILLION BUCKS.

And you know what millionaire Emma is gonna remember from college? Just how dang fun it was working as a bartender in her college town. (Emma went on to become a US Senator, while a respectable job not quite as care-free as her college days).

Our lives our filled with choices like this! Increase your income, decrease your expenses. Working instead of spending does both at once and can have a massive impact over the long term.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!