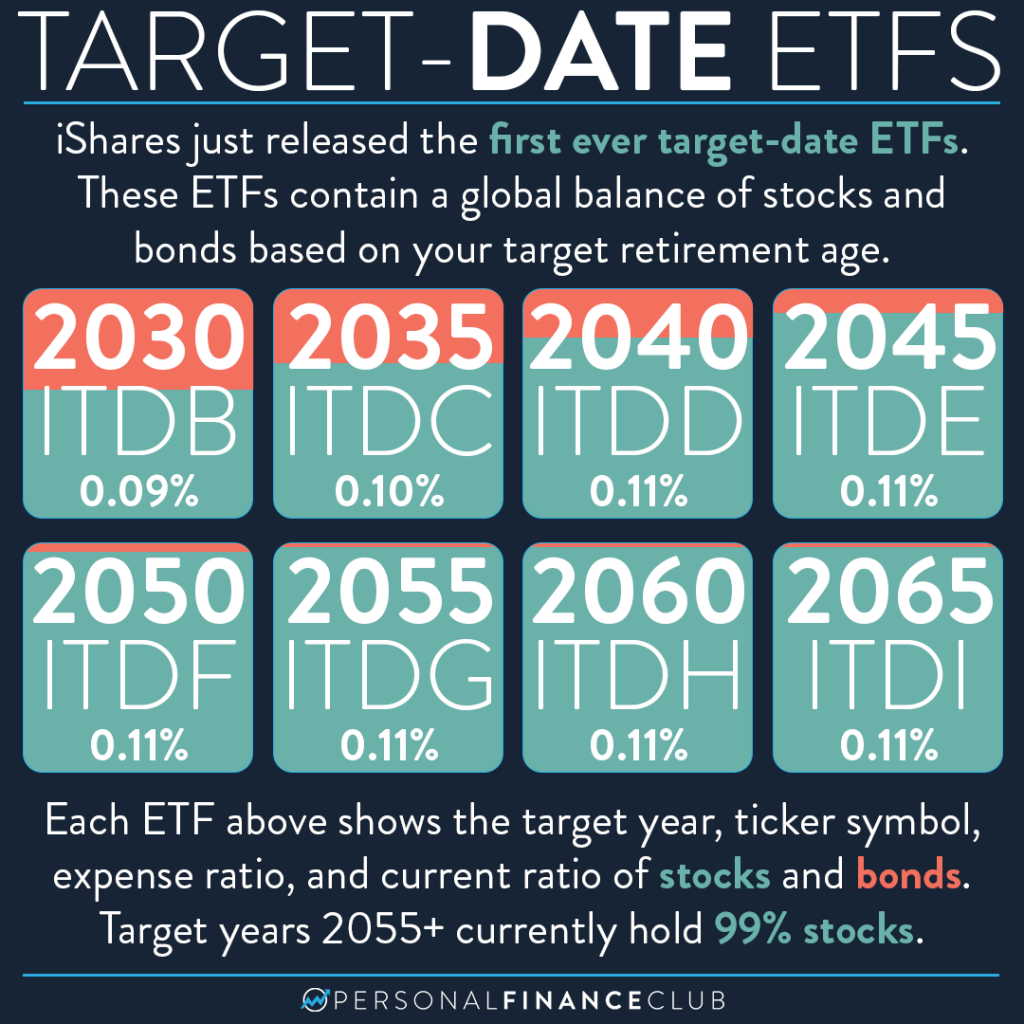

In terms of index fund investing news, this is pretty big. I’ve always wondered why most of the major brokerages offer target date index funds (the mutual fund version) but NOBODY offers target date ETFs. Well iShares JUST announced that is finally changing. As of today you can invest in target date ETFs!

ETFs offer some nice advantages over the mutual fund version. Notably, they trade for free on virtually every US platform AND they transfer easily between brokerages. Additionally, there’s an argument to be made that ETFs are more tax efficient (although my personal analysis into the topic indicates that real fiscal benefit is marginal at best). But a target date ETF WOULD likely avoid the kind of debacle we saw with Vanguard target date index funds a couple years ago when a big sell off of the funds cause a huge capital gain to be distributed to the remaining investors, resulting in an unexpected tax consequence.

A couple of the loosely credible critiques of target date index funds are 1.) their expense ratio is too high. That’s nonsense to me as these expense ratios are all 0.11% or lower, roughly equal to the cumulative expense of the underlying ETFs, and 2.) They’re too conservative. I never really bought that as Vanguard/Fidelity/Schwab target date funds are 90% stocks until the slow progression towards bonds begins. But iShares addressed that too and set their target date ETFs to 99% stocks for young people!

Those who follow me know that I’m a HUGE FAN of target date index funds! So this is big news for me. I’m pretty close to suggesting that everyone should be dumping every penny of their investments into a target date ETF based on their year, but the LAST remaining sticking point for me is that most brokerages don’t (yet) offer automated ETF investing. That means if you are investing regularly (like $500/month) you have a short homework assignment each month to login and click “buy” to buy more shares of your ETF.

But still, this is huge and likely a great option for tons of index fund investors!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!