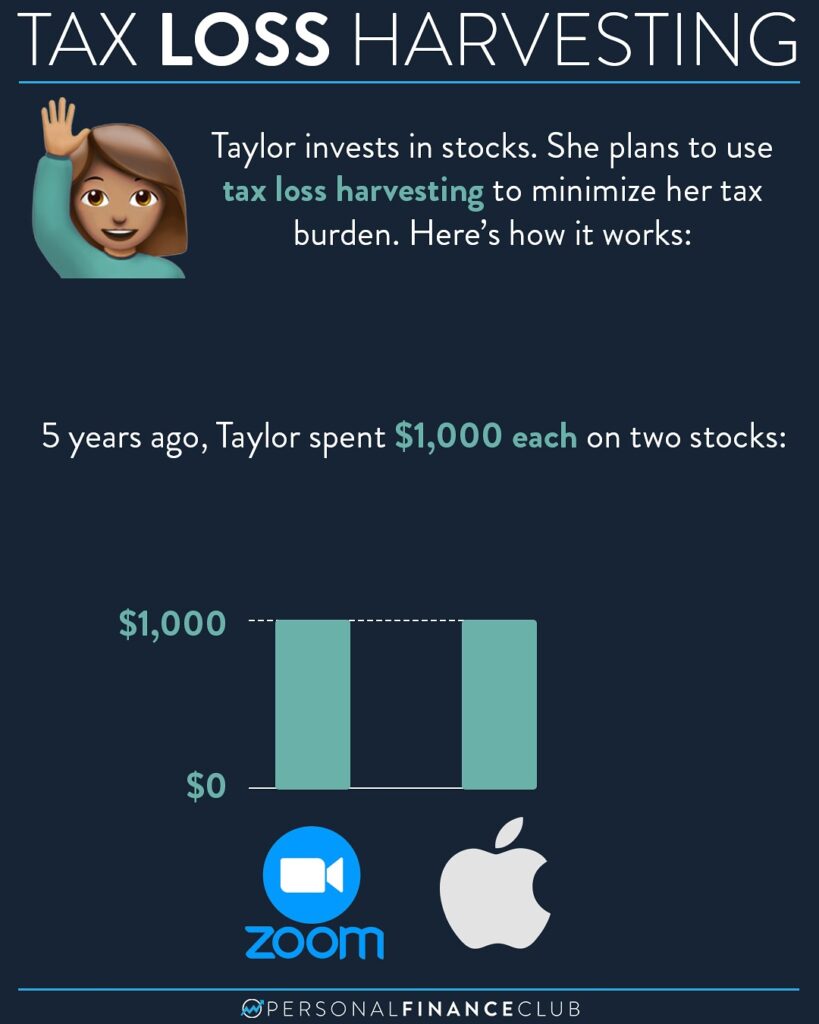

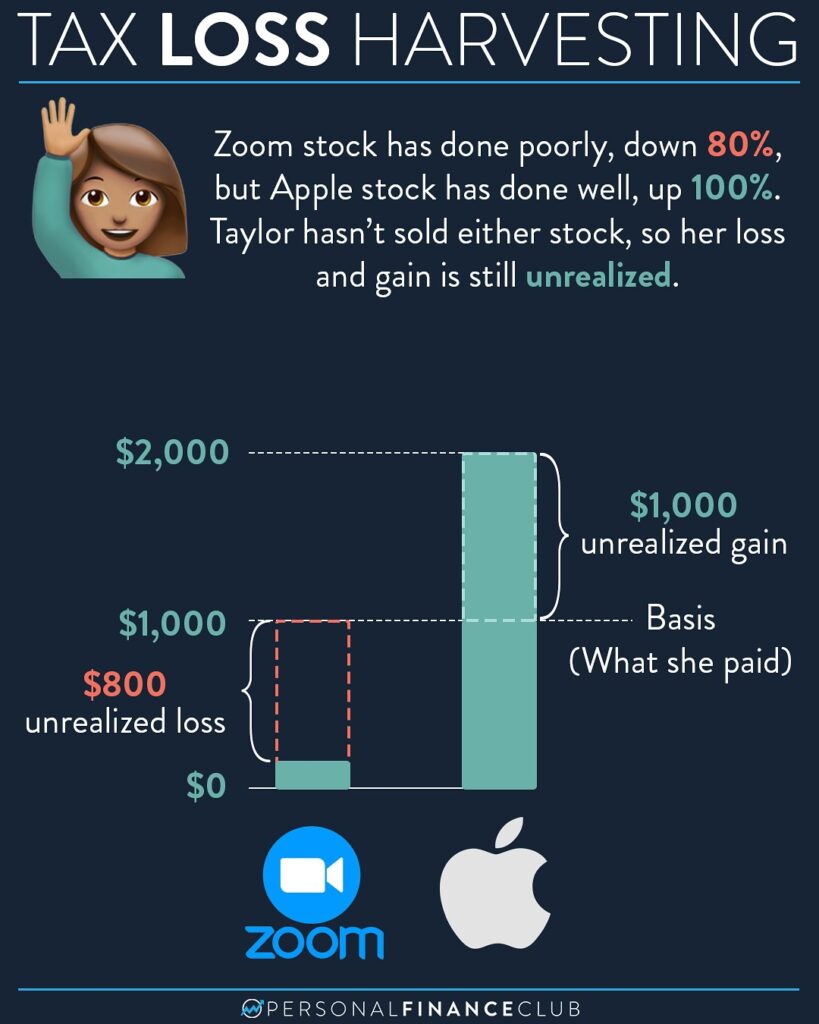

I see the term “tax loss harvesting” thrown around a lot in marketing materials for investment pitches. It’s often pitched as a magical way to get higher returns through some fancy financial footwork. But that’s not quite true.

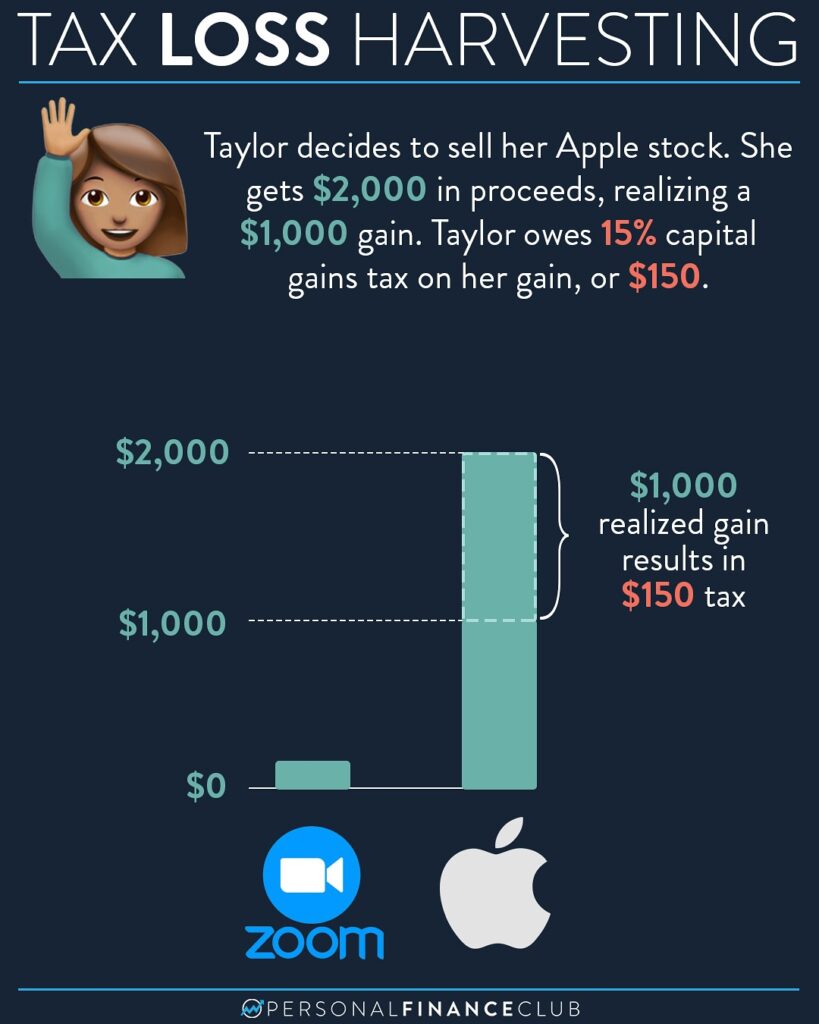

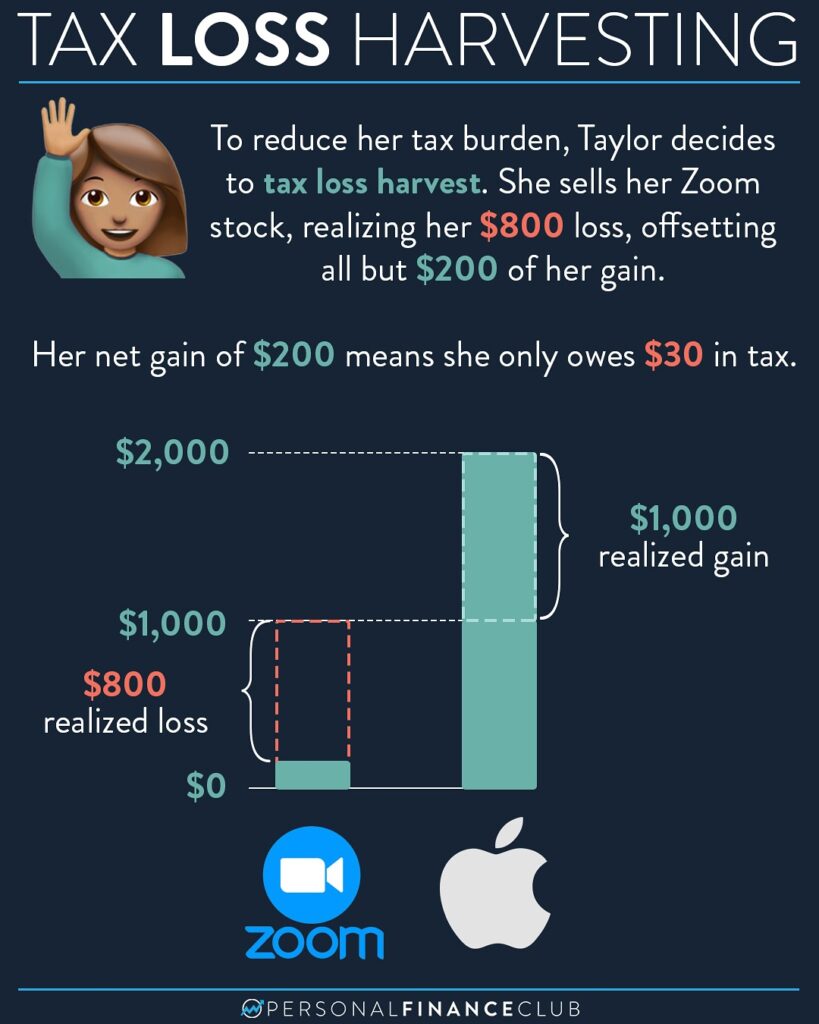

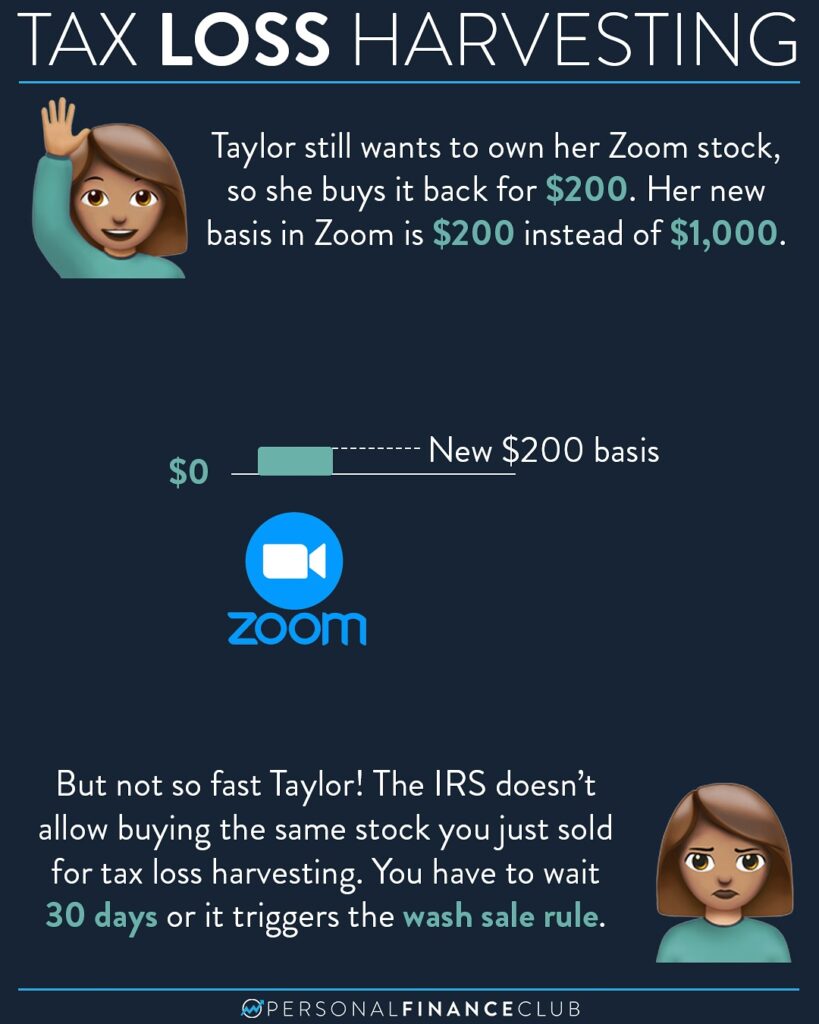

As shown in this post it’s a relatively simple strategy to sell something at a loss during years where you have a realized gain to reduce your tax burden on those gains. It’s definitely something to be aware of if you are ever looking at a large taxable gain. For example, if you sold a property that pushes you into a high tax bracket, it might be worth “tax loss harvesting” some stock that is down to reduce the tax owed on that gain.

That said, there are strategies where tax loss harvesting is used more aggressively. One such strategy is called “direct indexing”. Instead of buying a simple index fund ETF that tracks the S&P 500 (like VOO). You essentially buy up to 500 stocks individually, or enough to closely mirror the index. That gives more more flexibility to sell individual stocks at a loss every year, kicking off annual losses that can reduce your tax burden on other gains.

I’ve seen marketing material implying this increases your annualized after tax return. Even a small 0.5%-1% increase in return could have a meaningful long term impact on compound growth. But I don’t love it for a few reasons:

1.) It doesn’t avoid taxes, it just kicks the can down the road. Every time you harvest a loss, you’re pushing your basis down further and further. If one day you want to realize those gains you could end up in an even worse overall position depending on your tax bracket.

2.) Complexity. Owning dozens or hundreds of stocks with dozens or hundreds of different cost bases is just inviting complexity into your financial life. Additional complexity rarely results in a better financial outcome and almost always comes with logistical headaches.

That said, there are some tools to make this easier these days. One I like is called Frec. I don’t do direct indexing, but if I did that’s probably what I’d use.

As always, reminding you to build wealth by following the two PFC rules!

-Jeremy

September Sale!

September Sale!