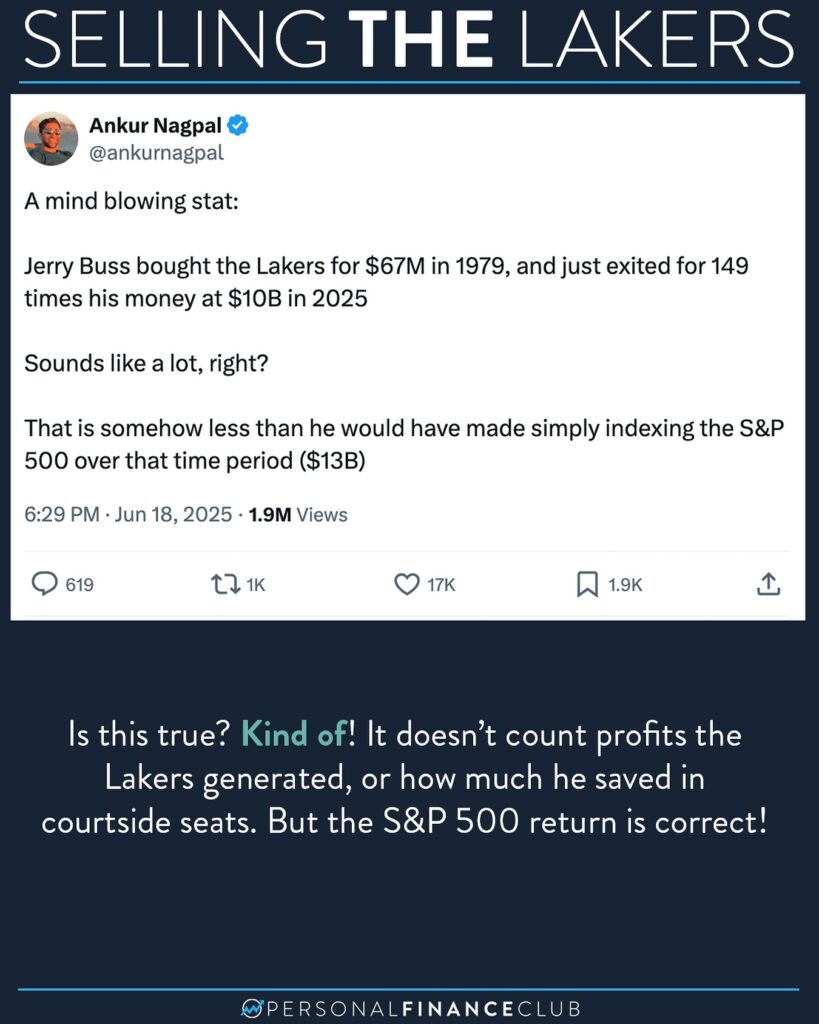

A ton of people have been sending me this, originally written by @ankurna, asking if it’s true. Did this INSANELY GOOD investment in the LA Lakers actually lose to buying an S&P 500 index fund?! On it’s surface, yes it’s true! At least, if you had invested $67.5M in the S&P 500 in 1979 and reinvested dividends, today you would have about $12.4B! But there’s a bunch of caveats:

• First, (as Ankur wisely point out in his original tweet) this doesn’t count any profits generated by the Lakers over the preceding 46 years. And certainly not reinvesting those profits as we did with the S&P 500 dividends. The Lakers are privately held, and thus don’t need to disclose their financials, but one would assume they have been profitable over the years.

• Owning an iconic basketball team is probably a lot of fun. I wouldn’t know. But I do know that owning an index fund is only a little bit of fun.

• Owning an iconic basketball team is almost certainly a lot of work. Owning an index fund is virtually no work.

• The math on the S&P 500 is assuming no fees, and no taxes on dividends paid along the way. If you count those things (hard to be exact here due to the nature of taxes) but I think it would put that investment more in the 9 billion dollar range.

All that said, which was the better investment?! I’d have to give the edge to the Lakers here (although it was a lot more work and risk too). The tougher question is which will be the better investment going FORWARD. Is this $10B purchase by the new owners a good one? Will it outperform the S&P 500? I have no idea, but most companies don’t. The majority of the gains of an index come from a few stocks that produce huge returns. No one knows what those stocks are ahead of time. That’s why, as Jack Bogle says, “Don’t look for the needle in the haystack. Just buy the haystack!”. i.e. even with hindsight and knowing how absolutely iconic and successful the Lakers have been from ‘79-‘25, they only arguably barely beat an index fund! What chance do we have picking winners going forward?

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!