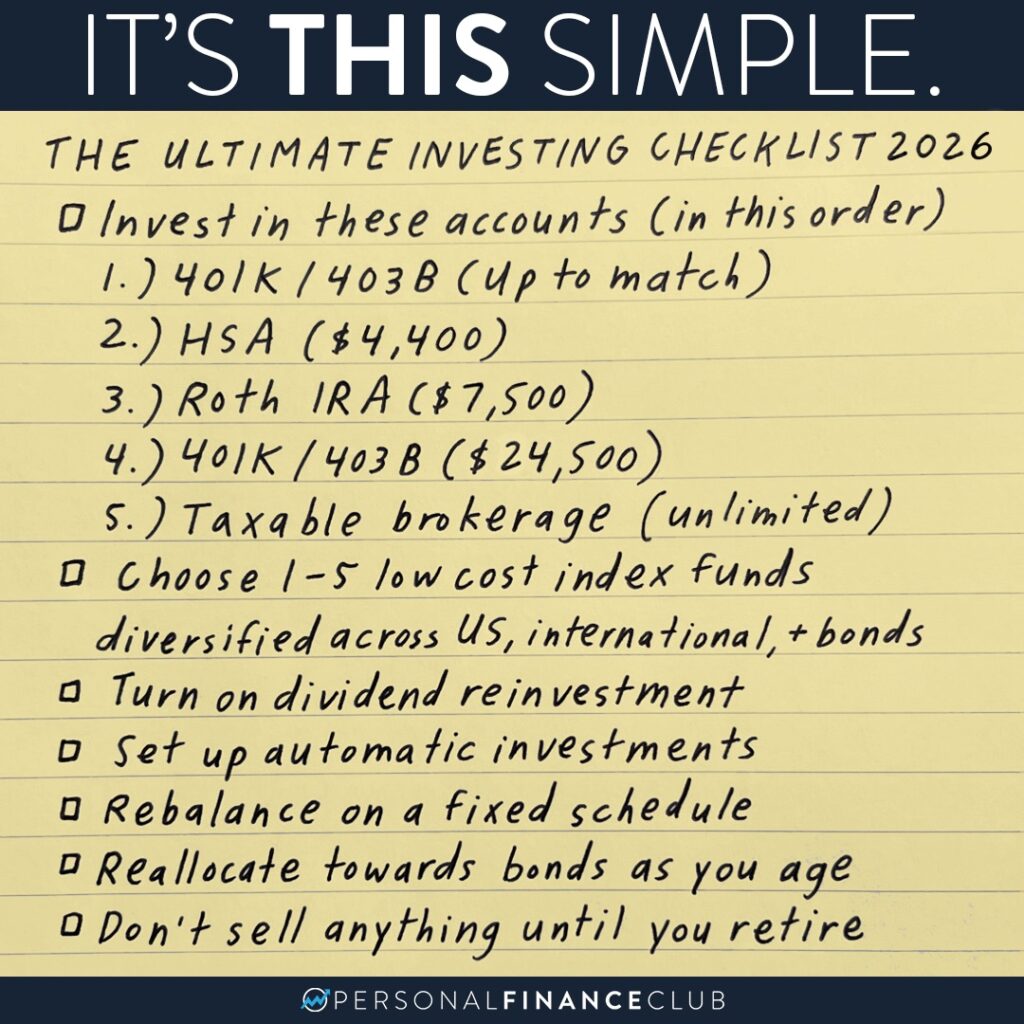

There is so much noise out there in the world of investing. But when you cut through all the nonsense, optimal investing is pretty simple. Here’s a checklist you can use to measure your investing strategy. This simple list optimizes your tax benefit, uses index funds to guarantee your fair share of US and international market growth, and eliminates notoriously bad human decision making through automated investing and rebalancing.

Note that if you use a single target date index fund for that second checkbox, you don’t have to choose an asset allocation and the rebalancing and reallocating checkboxes happen automatically.

It’s difficult to make an argument for another investing strategy that will beat what’s on this list without relying on luck or speculation. If you follow these simple steps, you’ll beat the vast majority of investors.

Note that the limits listed on this image are for a single person under 50. If you’re 50+ or making family contributions to an HSA your limits will be higher (+1,000 for IRA, +8,000 for 401k, $8,750 total for a family HSA).

Here’s the text if you want to copy and paste:

THE ULTIMATE INVESTING CHECKLIST 2026

□ Invest in these accounts (in this order)

1.) 401k/403b (up to match)

2.) HSA ($4,400)

3.) Roth IRA ($7,500)

4.) 401k/403b ($24,500)

5.) Taxable brokerage (unlimited)

□ Choose 1-5 low cost index funds diversified across US, international and bonds

□ Turn on dividend reinvestment

□ Set up automatic investments

□ Rebalance on a fixed schedule

□ Reallocate towards bonds as you age

□ Don’t sell anything until you retire

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

September Sale!

September Sale!