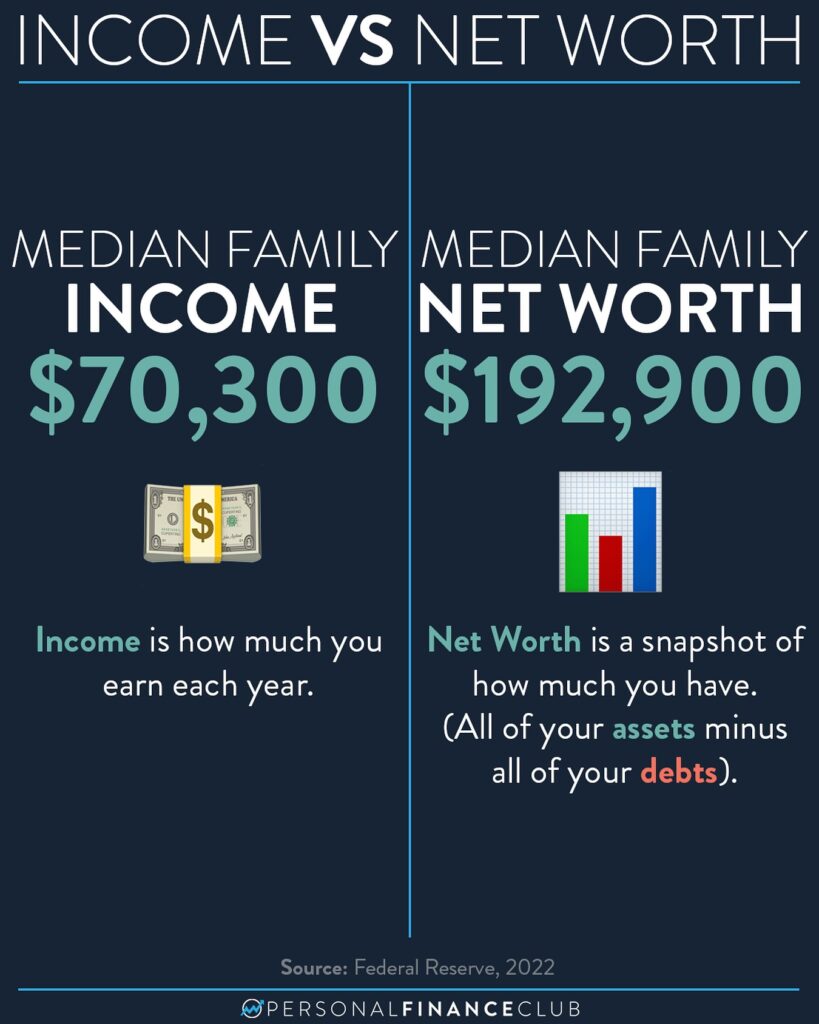

I recently posted about how Elon Musk as a net worth of $500 billion, which is a lot compared to the median family’s net worth of $192,900.

One of the most common comments on the post said something like “No way the average family is earning $192K/year”. WHOA THERE COMMENTER. You just committed two critical personal finance fallacies. First, you confused average and median, but I’ll forgive you for that. More importantly, you confused INCOME with NET WORTH. You’re right, $192K isn’t the median income. That’s because it’s NOT income. It’s net worth. It’s not how much families EARN per year, it’s how much they currently have.

Net worth includes ALL the stuff you OWN minus all the money you OWE. So a typical family’s net worth statement might look like this:

Assets:

Checking account: $2,000

401K account: $40,000

Home value: $300,000

Debts:

Mortgage: -$150,000

Net worth: $192,000

See how it works? You add up all the stuff you own, and subtract all the stuff you owe. So in the above family’s example, it’s not like they’re LOADED. Almost all of their money is in their 401k and their home equity.’

Net worth is the number that really matters. If your INCOME is $500K/year and you SPEND $500K/year, there’s a word for that: Broke. But increasing your net worth, especially in productive investments (like the stock market and investment real estate) means you can eventually LIVE off of your investments and be financially independent! I highly recommend it.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!